- While the ECB has a clear mandate “to maintain price stability”, the Fed has a dual mandate “to achieve maximum employment and price stability”.

- As inflation in the Eurozone is still not below 2% and even rose slightly in August (headline 2.1%, core 2.3%), the ECB will leave interest rate policy unchanged for the time being.

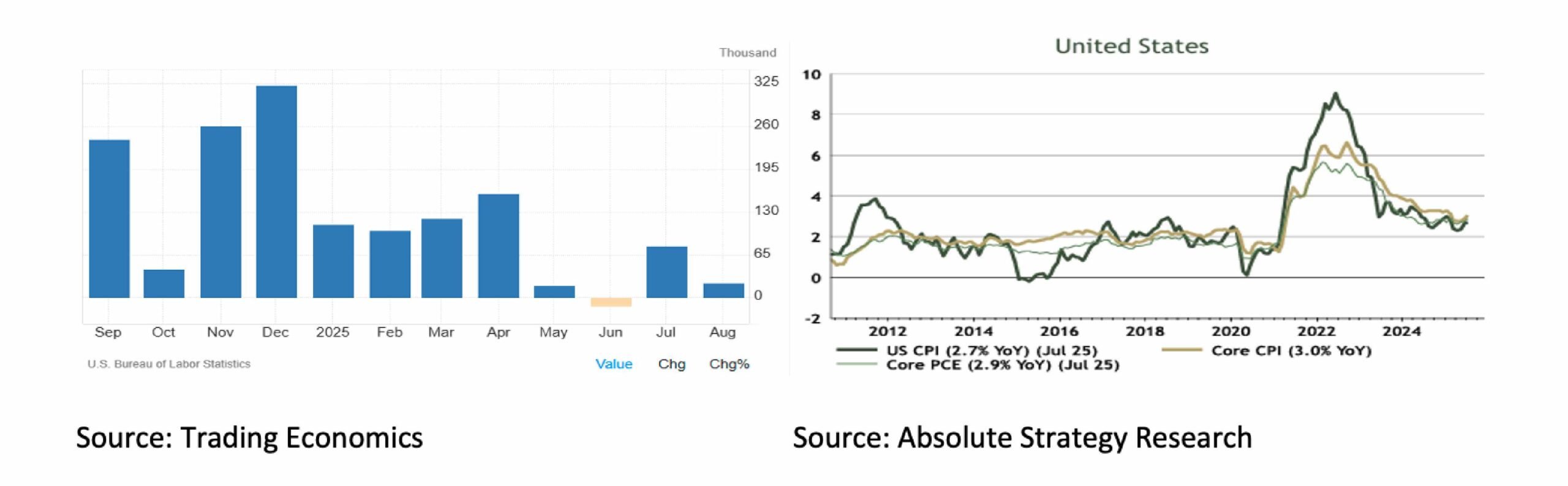

- The Fed, on the other hand, is caught in a dilemma. On the one hand, economic growth remains high and inflation is too high. On the other hand, job creation has been disappointing for four months in a row and unemployment is rising.

- Despite this balancing act, there's a good chance the Fed will lower interest rates in September. President Trump's continued pressure on the Fed to lower interest rates will certainly play a role in this decision.

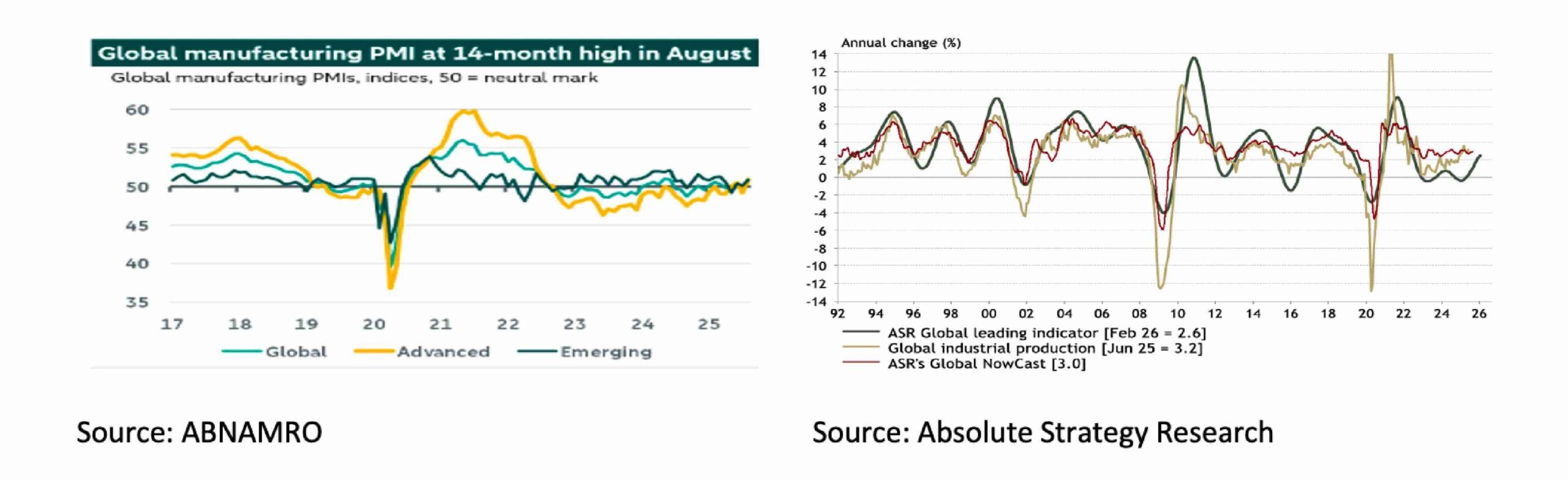

- The Fed's rate cut appear to come at a time when the outlook for the global economy in general and the manufacturing sector in particular is improving.

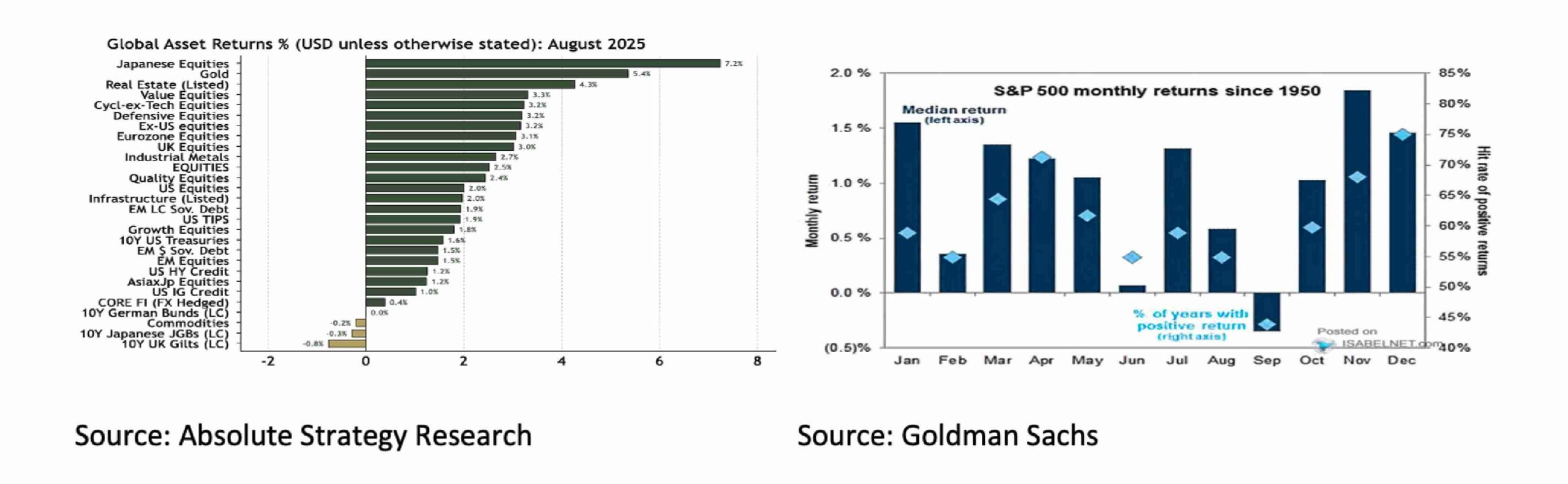

- The best performance (in USD) in August was achieved on Japanese equities (+7.2%) and on Gold (+5.4%), while Commodities (-0.2%), 10yr Japanese JGBs (-0.3%) and 10yr UK Guilts (-0.8%) underperformed significantly.

- September is historically not a good month for stocks. It's the only month of the year where the average return since 1950 has been negative, and returns have also been negative more often than positive.

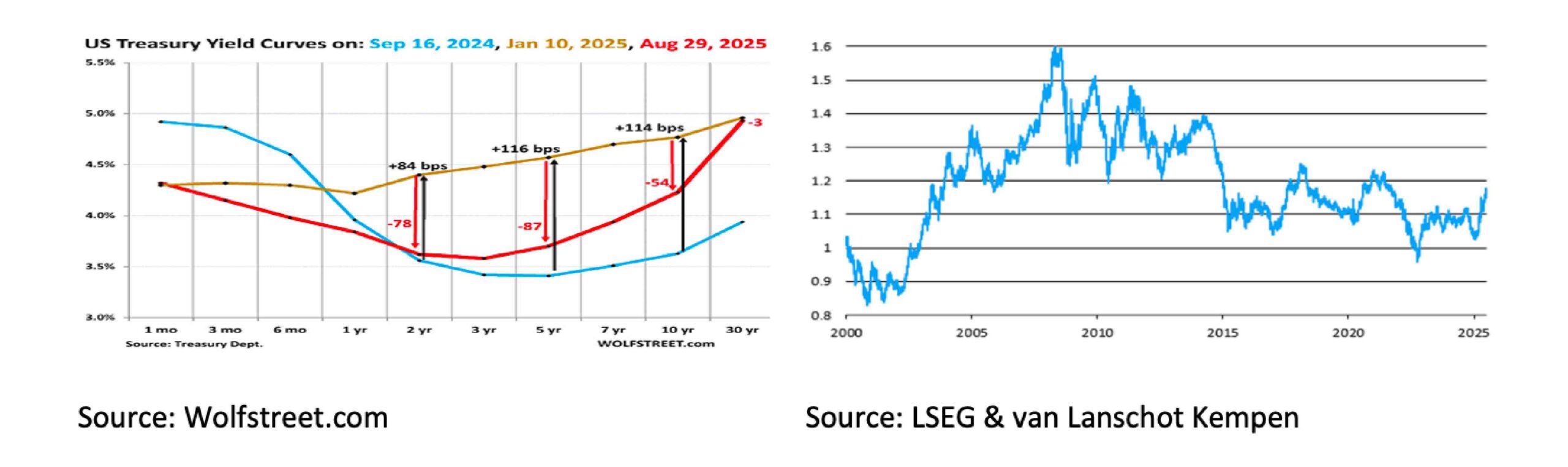

- Bonds with a maturity of up to two years can benefit from the Fed's upcoming rate cuts. While bonds with a 30 year maturity and an interest rate of almost 5% are attractive with inflation at 2.7% and a real interest rate of 2.3%.

- Doubts about the Fed's policy and its independence remain negative for the US Dollar against the Euro for now.

While the ECB has a clear mandate to "maintain price stability," the Fed has a dual mandate to "achieve maximum employment and price stability." Furthermore, the ECB targets 2% inflation over the medium term, while the Fed targets 2% inflation over the long term. The consequences of these different mandates will likely lead to differences in interest rate policy this month. Because inflation in the Eurozone is still not below 2% and even rose slightly in August (headline 2.1%, core 2.3%), the ECB will leave interest rate policy unchanged for the time being. The Fed, on the other hand, is caught between two extremes. On the one hand, the Atlanta Fed expects the same high economic growth in 25Q3 as in 2025Q2 (3.0% qoq annualized), and inflation (headline 2.7%, core 3.1%) is too high. On the other hand, job creation has been disappointing for four consecutive months, and unemployment is rising (4.3%).

Despite this balancing act, there's a good chance the Fed will lower interest rates in September. President Trump's relentless pressure on the Fed to lower interest rates will also play a role. According to President Trump, these rate cuts are necessary to stimulate employment and keep the (excessively) high US government debt affordable and financeable. While the latter is becoming an increasing risk, the former is more a consequence of President Trump's own policies. As a result of the tariff war, companies have been reluctant to hire additional staff in recent months, and the increased deportations of undocumented immigrants have also reduced the availability of cheap labor. Moreover, the Fed's rate cuts appear to be coming at a time when the outlook for the global economy in general and the manufacturing sector in particular is improving.

The highest performance (in USD) in August was achieved by Japanese equities (+7.2%) and our "long-term favorite" gold (+5.4%), while bonds in general, and 10-year Japanese JGBs (-0.3%) and 10-year UK Guilts (-0.8%) in particular, again significantly underperformed. Commodities' performance (-0.2%) was disappointing, following the strong performance in July (+3.6%). While August was a good month for equities, September historically doesn't bode well. It's the only month of the year in which the average return since 1950 has been negative, and returns have also been negative more often than positive.

With the Fed's interest rate cuts on the horizon, it's interesting to look at the US yield curve. Since September of last year, interest rates on 2- to 30-year maturities have all risen. This is due to increased inflation concerns. However, these same rates, with the exception of the 30-year yield, have also fallen from January to now. This indicates that markets are no longer ruling out a recession. It also means that the longer end of the yield curve has steepened significantly this year. A "normal" yield curve would more closely resemble the shape of the yellow line. Therefore, the expectation is that bonds with maturities of 2 years or less will particularly benefit from the Fed's upcoming rate cuts. Meanwhile, bonds with a 30-year maturity and an interest rate of almost 5% are attractive with inflation at 2.7% and a real interest rate of 2.3%. The US dollar have already fallen by around 12% against the euro in 2025. At the current rate of 1.17, it is roughly at the average rate since the introduction of the euro on January 1, 1999, although there was a wide range between 0.825 and 1.60. Doubts about the Fed's policy and its independence remain negative for the US dollar for the time being.

Disclaimer:

While the information in the document has been formulated with all due care, it is provided by Trustmoore for information purposes only. It does not constitute an offer, invitation or inducement to contract, and the information herein does not contain legal, tax, regulatory, accounting or other professional advice. Therefore, we encourage you to seek professional advice before considering a transaction described in this document. No liability is accepted whatsoever for any direct or consequential loss arising from the use of this document. The text of this disclaimer is not exhaustive; further details can be found here.