- Economic growth in the Eurozone in 25Q2 was +0.1% (QoQ). Inflation rose slightly but remained close to the ECB's 2.0% target at +2.0% (headline) and 2.3% (core).

- This was a reason for the ECB not to lower interest rates further at the end of July.

- US economic growth was far better than expected at +3.0% (QoQ annualized). Inflation remained elevated at +2.7% (headline) and +2.9% (core).

- High economic growth and inflation prompted the FED to leave interest rates unchanged at the end of July.

- Given the low number of jobs added in May (+19k), June (+14k) and July (+73k) and the pressure from President Trump on FED Governor Powell, the expectation is that the FED will cut the interest rate in September.

- In the Eurozone, the way appears clear for a synchronised increase in net government investment that will give the European economy a strong boost.

- In the US, “Household leverage” is at its lowest level in 50 years.

- The highest performance (in USD) in July was achieved on Commodities (+3.6%) and Equities (+1.4%).

- The return on equities over the past 12 months (+16.1%) is largely due to profit growth (+11.0%) and dividends (+2.4%).

- US High Yield and Emerging Market Bonds remain attractive versus UST thanks to a spread of +278bp and 276bp respectively.

- The USD is expected to appreciate in the remainder of 2025, which is positive for investments in US assets.

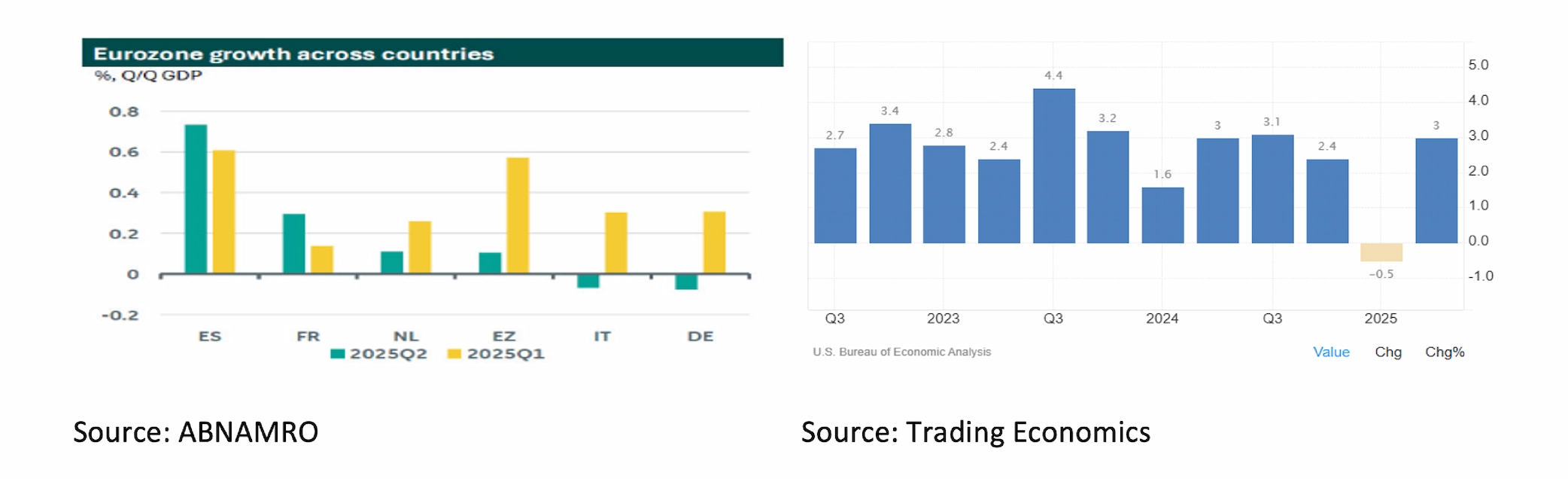

Economic growth in the Eurozone in 25Q2 was only +0.1% (QoQ). Notable were the negative growth in Germany (-0.1%) and Italy (-0.1%), and the positive growth in Spain (+0.7%) and Portugal (+0.6%). Inflation in the Eurozone rose slightly but remained close to the ECB's 2.0% target at +2.0% (headline) and +2.3% (core), respectively. Therefore, the ECB saw no reason to lower interest rates further at the end of July. Economic growth in the US was substantial at +3.0% (QoQ annual). Conversely, inflation remained too high at +2.7% (headline) and +2.9% (core). The high economic growth and inflation prompted the Fed to leave interest rates unchanged at the end of July, much to the frustration of President Trump, who again hinted at the resignation of Fed Governor Powell. Given this pressure and the low number of jobs added in May (+19,000), June (+14,000), and July (+73,000), the Fed is expected to lower interest rates in September. However, the low number of new jobs is largely due to President Trump himself, as his "reciprocal tariffs" are creating significant uncertainty for businesses.

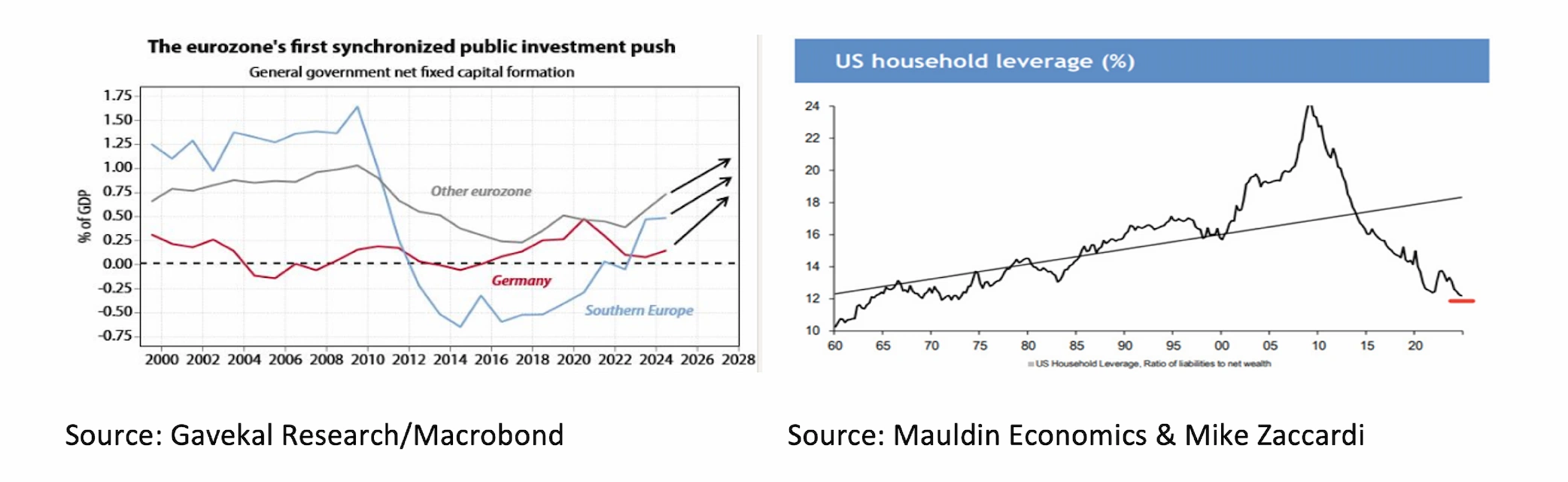

Despite low growth in 25Q2, the economic outlook for the EU appears positive. The EU's Covid-era investment package expires in August 2026. The remaining funds, combined with increased defense spending and Germany's infrastructure package, pave the way for a synchronized increase in net government investment, which will provide a strong boost to the European economy just as the broader cyclical recovery is gaining momentum. While President Trump continues to create unrest and thus risks, the outlook for the US is still not bad. US household leverage (liabilities to net wealth) is at its lowest in 50 years.

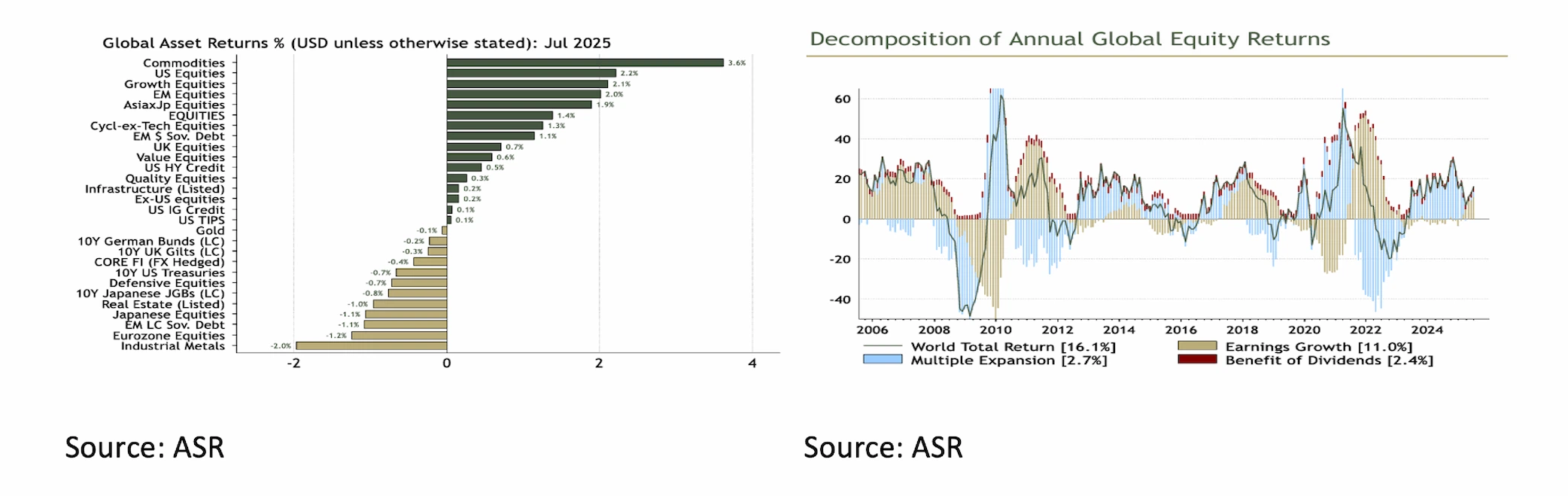

The highest performance (in USD) in July was achieved in commodities (+3.6%) and equities (+1.4%). The difference in performance between US equities (+2.2%) and eurozone equities (-1.2%) was notable, although this was almost entirely due to a rise in the US dollar (+3%). The rise in corporate profits remains positive for equities. The return on equities over the past 12 months (+16.1%) is largely due to earnings growth (+11.0%) and dividends (+2.4%). Only a small portion was due to multiple expansion (+2.7%).

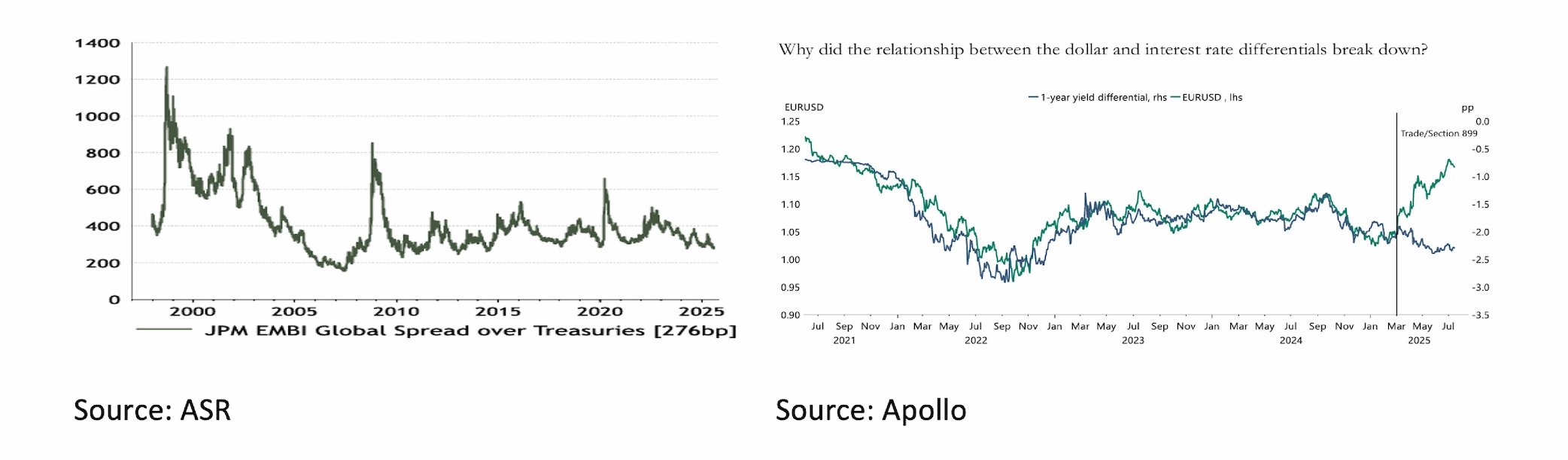

The ongoing bull market in equities stands in stark contrast to the bear market in the US Aggregate Bond Index. Since August 2020, the return is -17.2%. UST10yr bonds, with a yield of 4.25%, still don't seem attractive enough with core inflation of +2.7%. US High Yield and Emerging Market Bonds are a positive exception, thanks to their spreads of +278bp and 276bp, respectively, against UST. Although the US dollar was significantly overvalued against the euro, the GBP, and the JPY at the beginning of this year, the degree of weakness of the US dollar so far in 2025 is remarkable. For example, the US dollar has fallen considerably more than would have been expected based on the development of interest rate differentials. The decline therefore appears to be more attributable to uncertainty surrounding President Trump's economic policies, such as "reciprocal tariffs," Section 899 of the "Big Beautiful Bill," and the Mar-a-Lago Agreement. Now that most of the uncertainties on these issues are behind us, the expectation is that the US Dollar can appreciate somewhat in the remainder of 2025, which is positive for investments in US assets.

Disclaimer:

While the information in the document has been formulated with all due care, it is provided by Trustmoore for information purposes only. It does not constitute an offer, invitation or inducement to contract, and the information herein does not contain legal, tax, regulatory, accounting or other professional advice. Therefore, we encourage you to seek professional advice before considering a transaction described in this document. No liability is accepted whatsoever for any direct or consequential loss arising from the use of this document. The text of this disclaimer is not exhaustive; further details can be found here.