- The month of September was dominated by the ever-increasing government debt in many countries.

- In France, Prime Minister Francois Bayrou was sent home after both parliament and the people failed to accept the proposed reforms.

- In the US, the government went into a so-called “shutdown” because Republicans and Democrats could not agree on raising the debt ceiling.

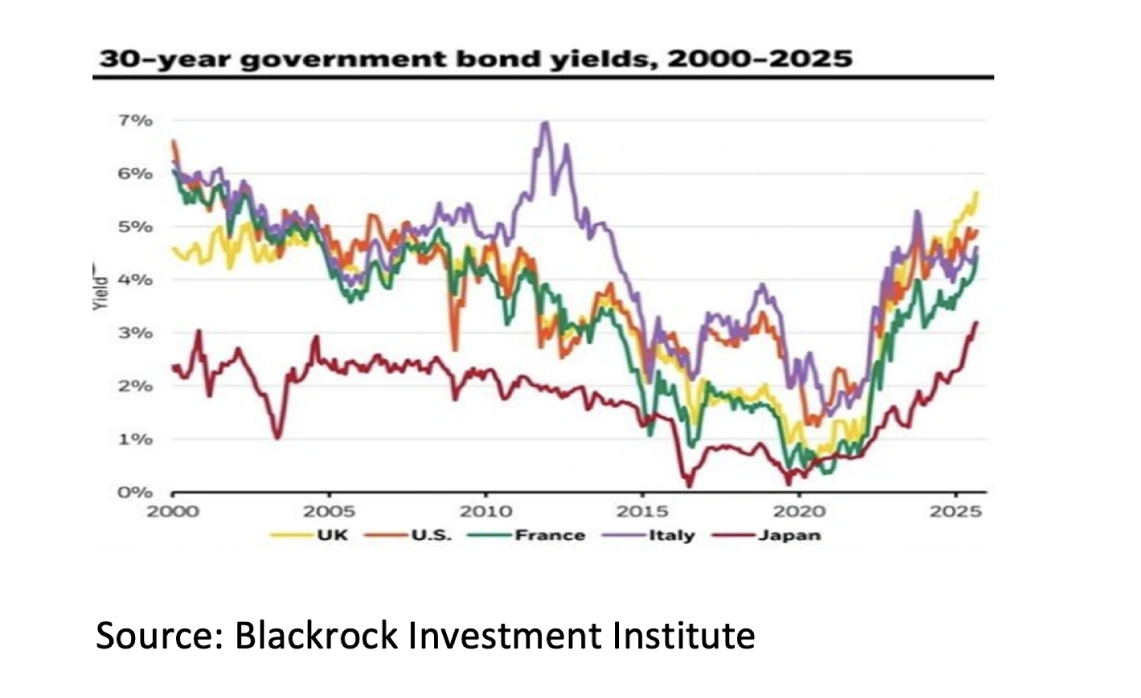

- The fact that the financial markets are becoming increasingly concerned about these ever-increasing government debts is reflected in the sharp rise in long-term interest rates worldwide since 2020.

- However, a new financial crisis like in Asia ('97/'98), Global ('08) and Eurozone ('12/'13) does not seem to be imminent (for the time being).

- The economic outlook remains good. For example, the Atlanta Fed expects US economic growth of 3.8% (annualized) in 2025Q3.

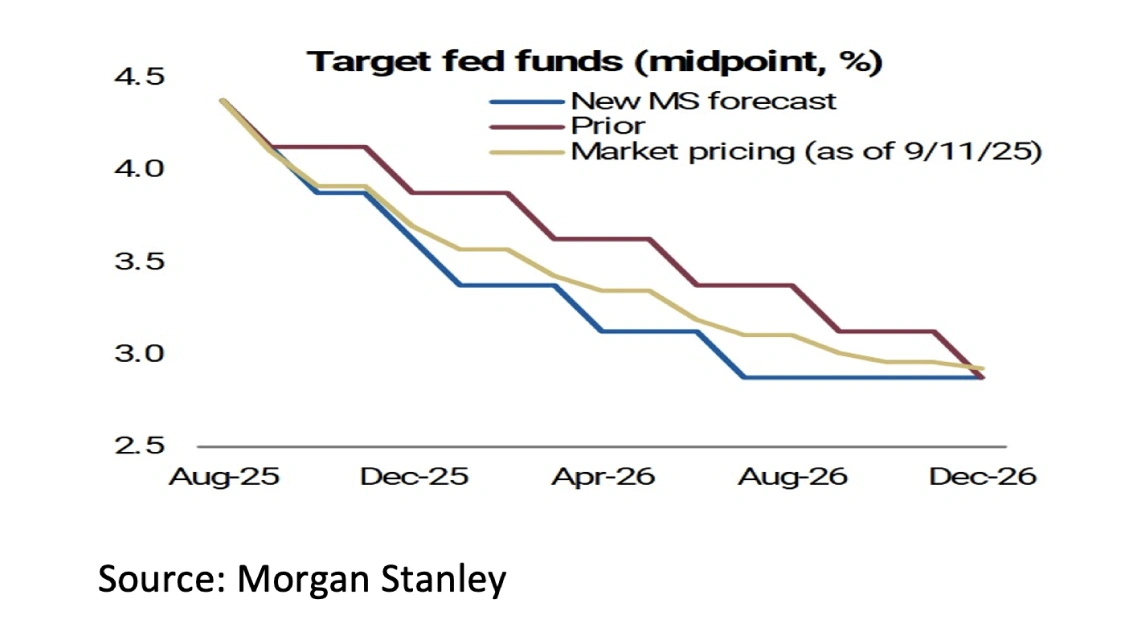

- After the rate cut in September, the Fed is expected to cut rates further in 2025Q4 and in 2026.

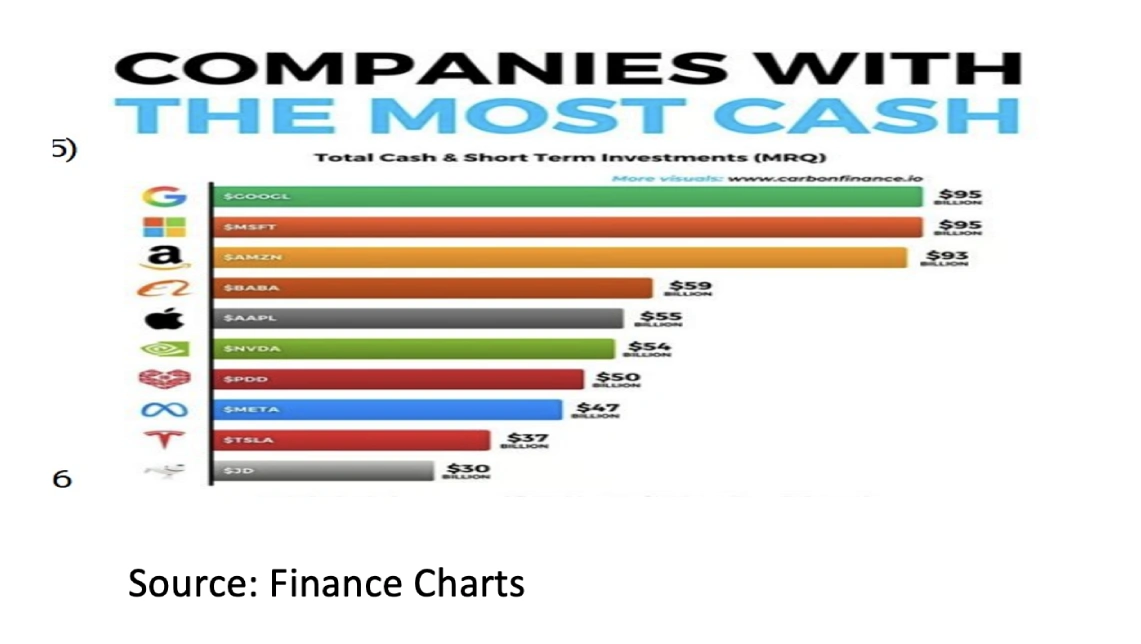

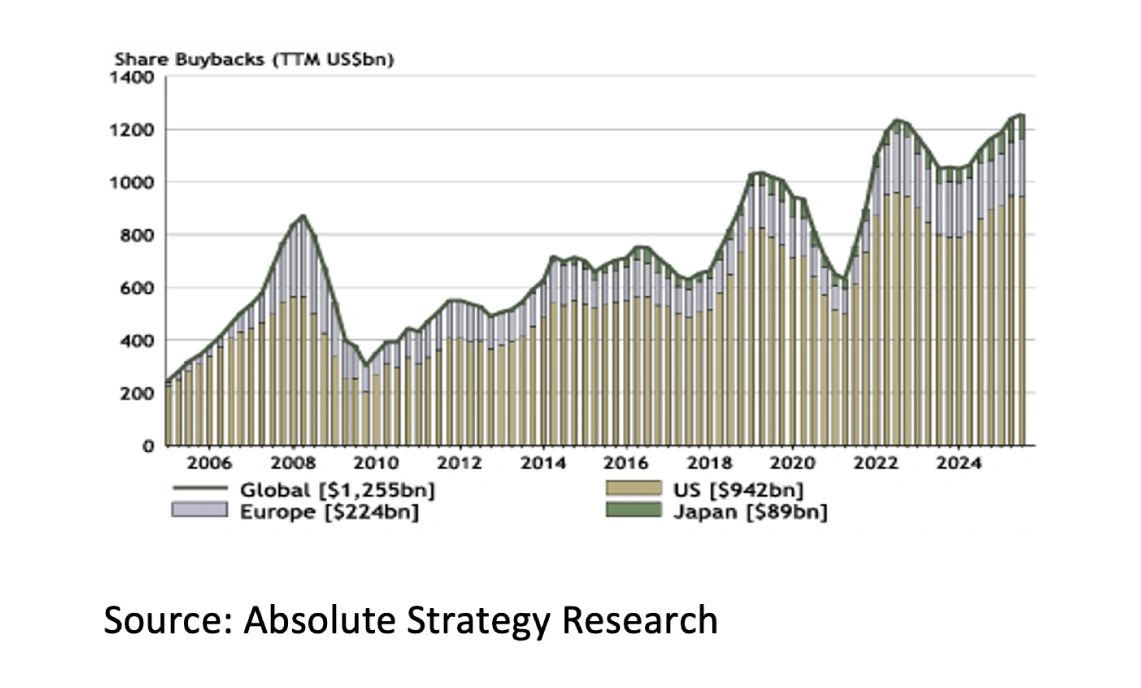

- Unlike governments, many companies have huge cash positions.

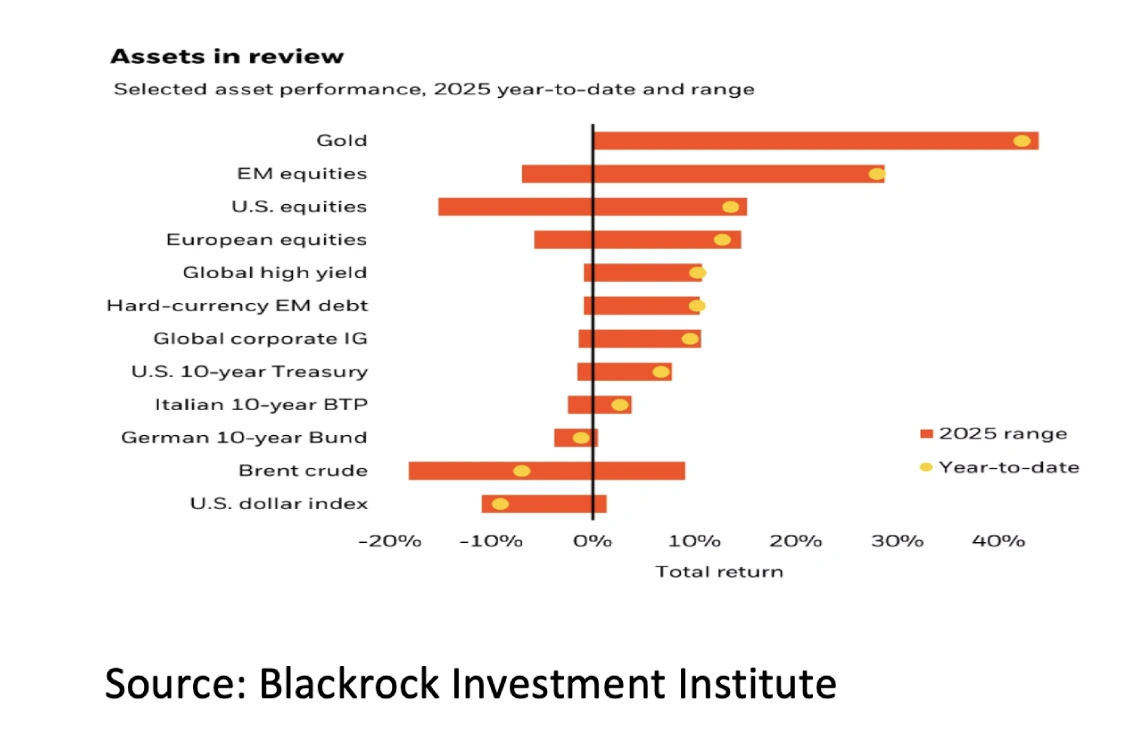

- Both year-to-date (+47.2%) and in September (+10.5%) Gold (in USD) was the star performer, with Emerging Market equities second both year-to-date (+28.2%) and in September (+7.2%).

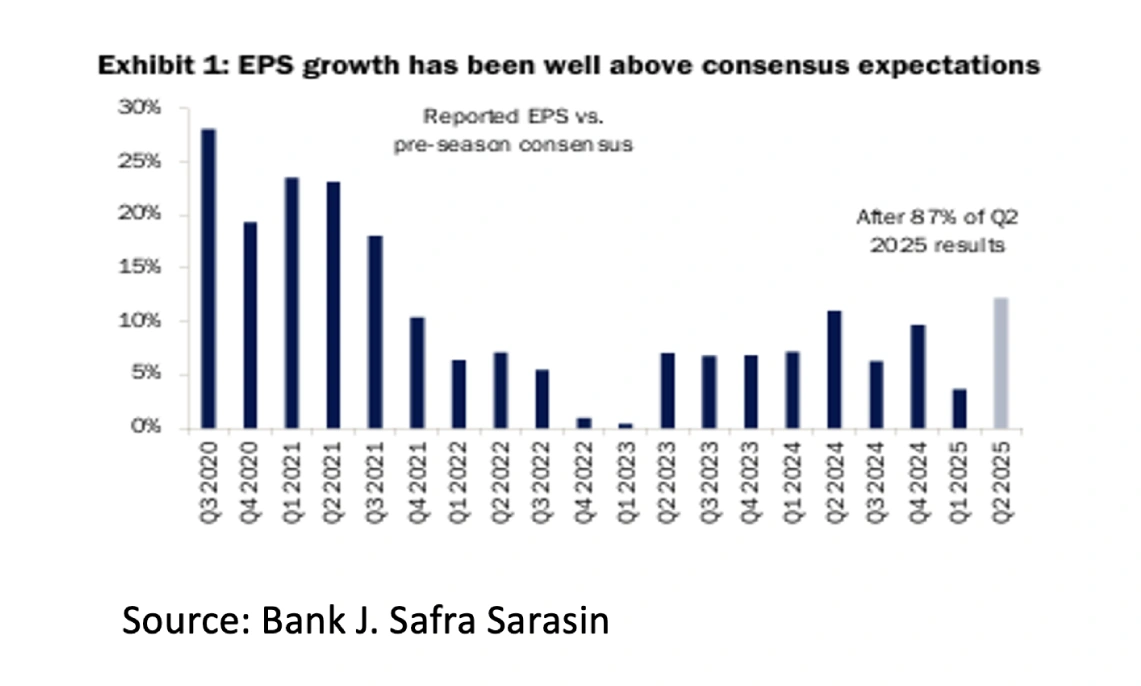

- In addition to better-than-expected profits and share buybacks, the economic outlook remains good and the Fed is expected to lower interest rates also in 2025Q4 and 2026. The peak in the stock markets therefore appears not to have been reached yet.

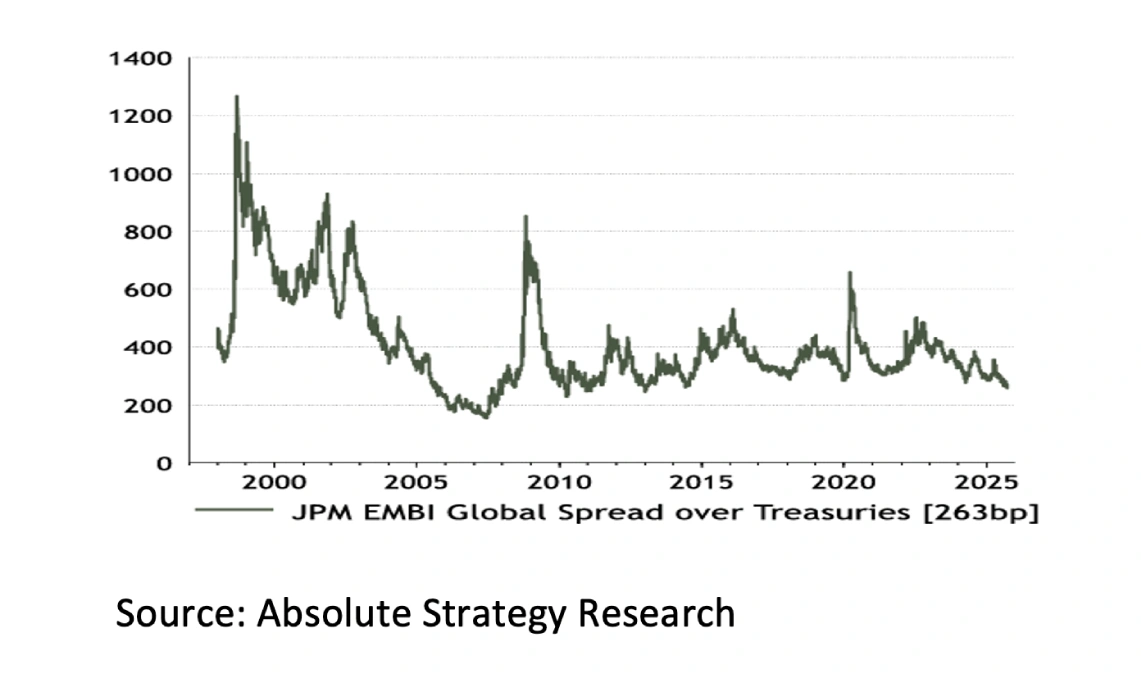

- As a diversifier alongside equities and Gold, Emerging Market Debt in USD, with a spread of +263bp over US Treasuries, is attractive.

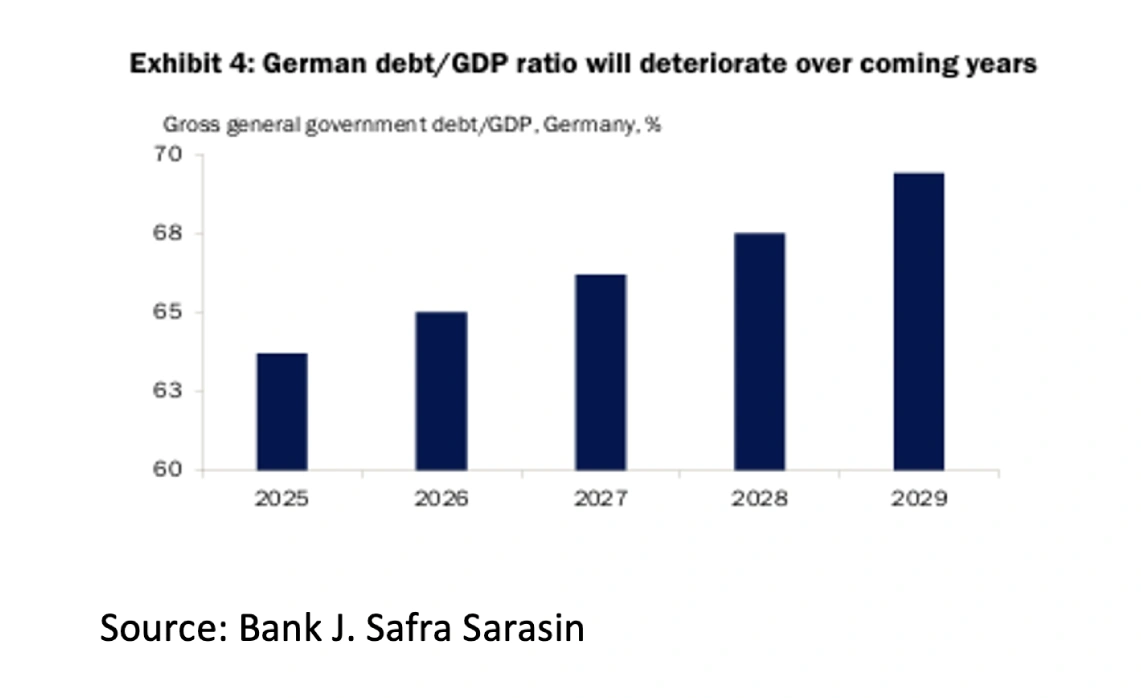

In many countries, September was dominated by the ever-increasing government debt. In France, Prime Minister Francois Bayrou was expelled because both the French parliament and the French people refused to accept the proposed structural reforms. In the US, the government once again went into a so-called "shutdown" because Republicans and Democrats could not agree on raising the debt ceiling. The fact that the high debt-to-GDP ratios of France (113%) and the US (123%) are not isolated is demonstrated by the figures for the UK (98%), Italy (135%), and Japan (237%). Worryingly, even a country like Germany (63%) recently announced it would abandon the "Schuldenbremse" (debt brake). The growing concern in financial markets is clearly reflected in the sharp rise in long-term interest rates worldwide since 2020.

Although a financial crisis like those in Asia ('97/'98), the Global ('08), and the Eurozone ('12/'13) cannot be ruled out, it does not seem imminent (for now). First, Japan (237%) shows that an even higher debt ratio is possible. Second, central banks have the means to combat a potential financial crisis in a timely manner. For example, since 2022, the ECB has had the Transmission Protection Instrument (TPI), which allows it to purchase government bonds from countries with disproportionately high interest rates. Third, the economic outlook remains positive. For example, the Atlanta Fed expects US economic growth of 3.8% (annualized) in 2025Q3, and after the interest rate cut in September, the Fed will also lower interest rates further in 2025Q4 and 2026 to stimulate the economy. Fourth, many companies have enormous cash positions against government debt.

Gold (in USD) was the star performer both year-to-date (+47.2%) and in September (+10.5%). Central banks have been expanding their gold reserves for some time to better diversify their reserves. This plays a particularly important role in countries that want/need to be less dependent on the US and the USD. Investors are also buying gold as a hedge against structurally rising inflation. After gold, emerging market equities are second both year-to-date (+28.2%) and in September (+7.2%). Furthermore, the recovery of the S&P 500 since its bottom on April 8 (+34.2%) remains remarkable. This recovery is partly due to the fact that the "reciprocal tariffs" announced by President Trump have proven to be less than expected. Furthermore, corporate profits have consistently been well above expectations.

The ever-increasing share buybacks also remain positive for equities. For US equities in particular, these are a key factor in the continued rise in prices. Besides positive profits and share buybacks, the economic outlook remains positive for now, and central banks, such as the Fed, are expected to lower interest rates also in 2025Q4 and 2026. Therefore, the peak in the equity markets appears to have not yet been reached. For investors with a fear of heights or a need for diversification, Emerging Market Debt in USD, with a spread of +263bp over US Treasuries, appears to be an attractive alternative, in addition to equities and gold.

Disclaimer:

While the information contained in the document has been formulated with all due care, it is provided by for information purposes only and does not constitute a professional advice. We would encourage you to seek appropriate professional advice before considering a transaction as described in this document. No liability is accepted whatsoever for any direct or consequential loss arising from the use of this document.