- There are currently enough (economic) developments that cause concern.

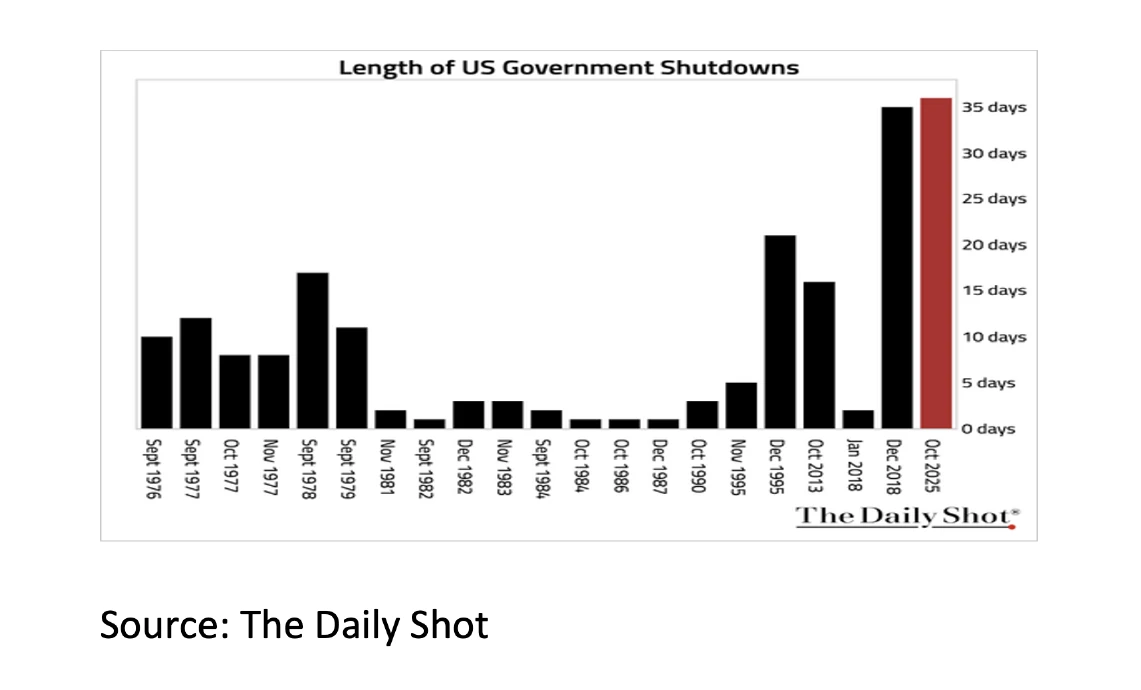

- The US has never had a Government Shutdown last this long.

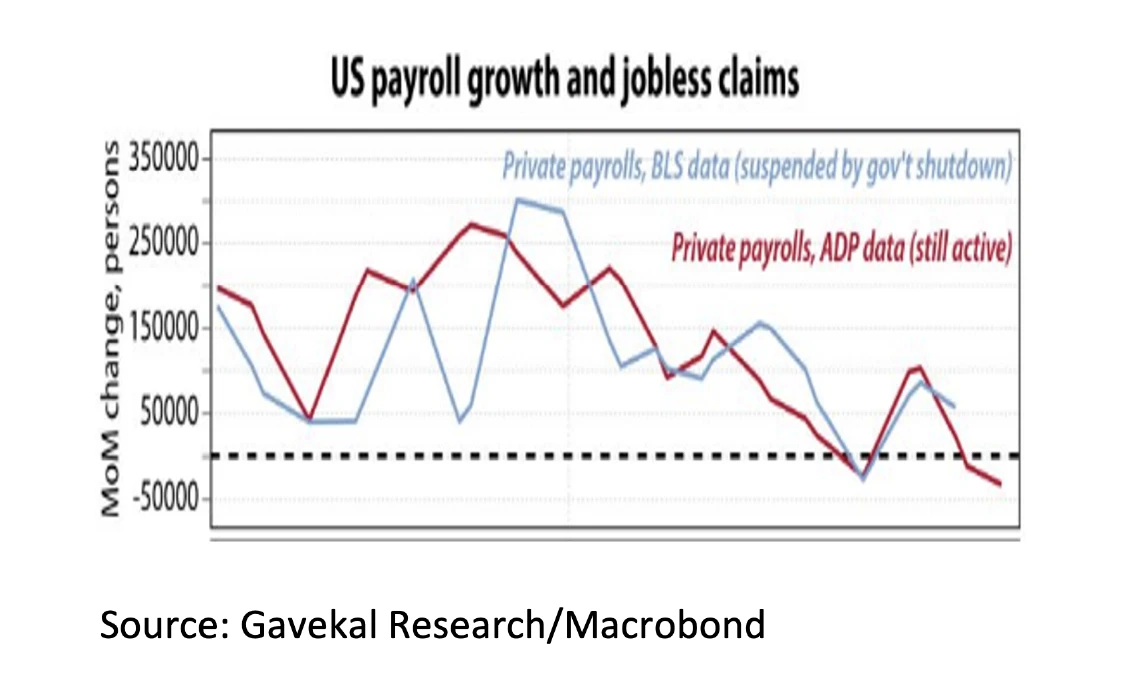

- The US labor market is clearly deteriorating.

- In Germany, the manufacturing sector has been in recession for a record 40 months and the economy has grown in only 2 of the last 12 quarters.

- In almost all Western countries, government debt is rising at an alarming rate and inflation in the US, the EU and the UK remains structurally (too) high.

- However, there are also still plenty of positive (economic) developments.

- The Atlanta FED expects US economic growth to be +4% (annualized) in 25Q3.

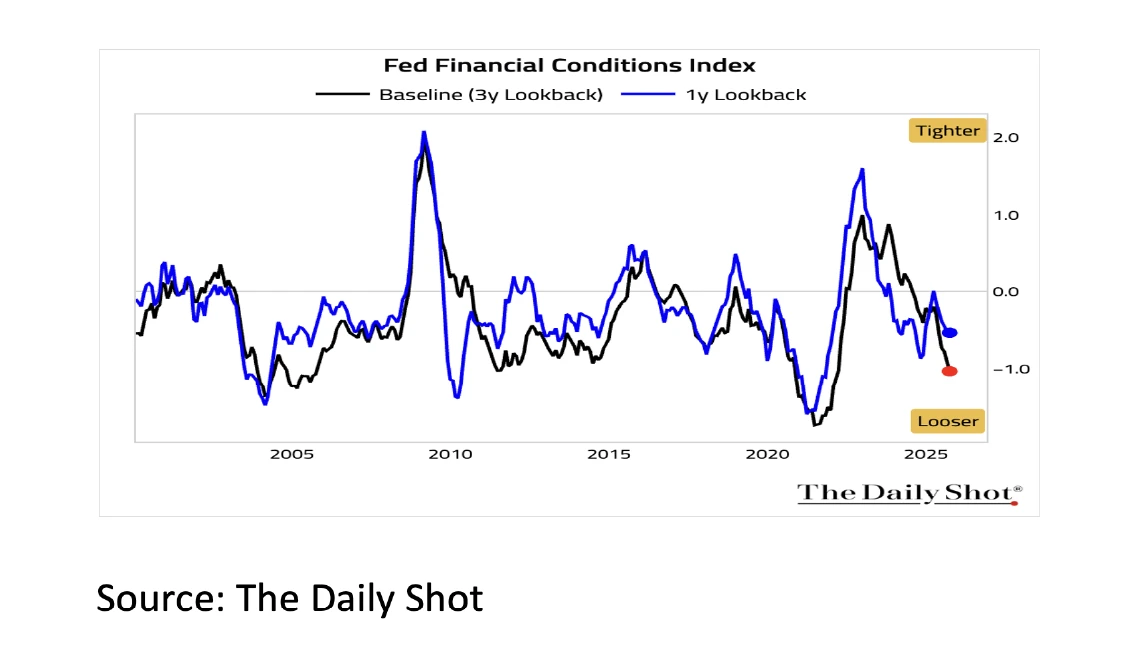

- The Fed cut interest rates again by 0.25% at the end of October, does not rule out further cuts and considers current financial conditions as “the most accommodative since early 2022”.

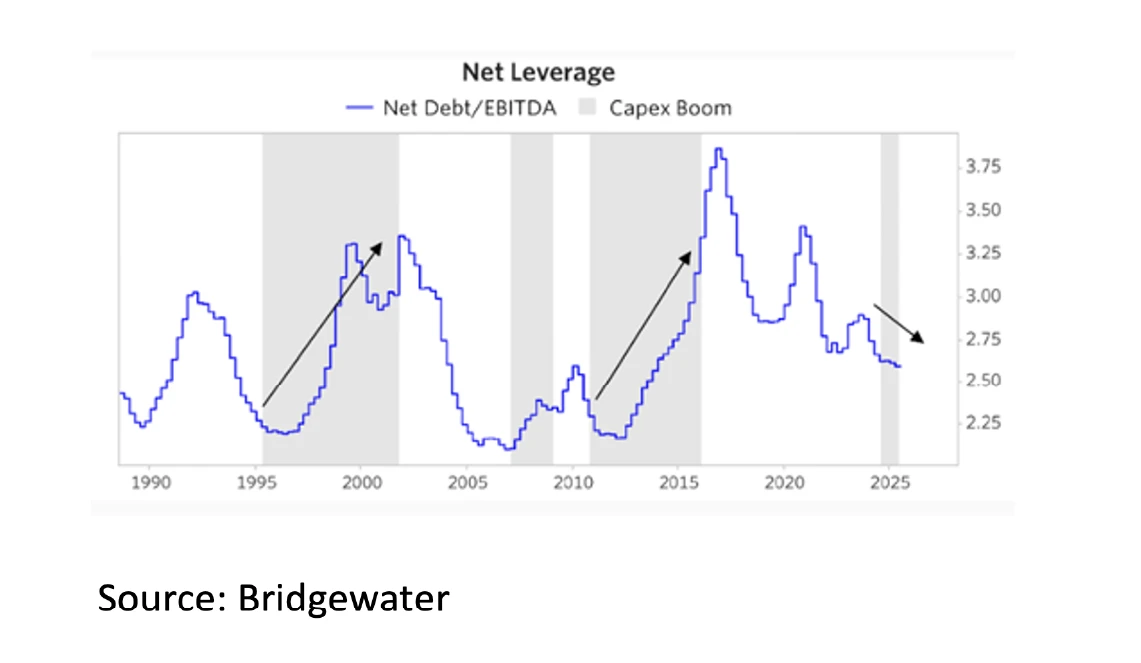

- The capex boom in Artificial Intelligence is largely financed by the cash flow of companies themselves and is therefore incomparable with the capex boom that led to the Dot Com crisis at the beginning of this century.

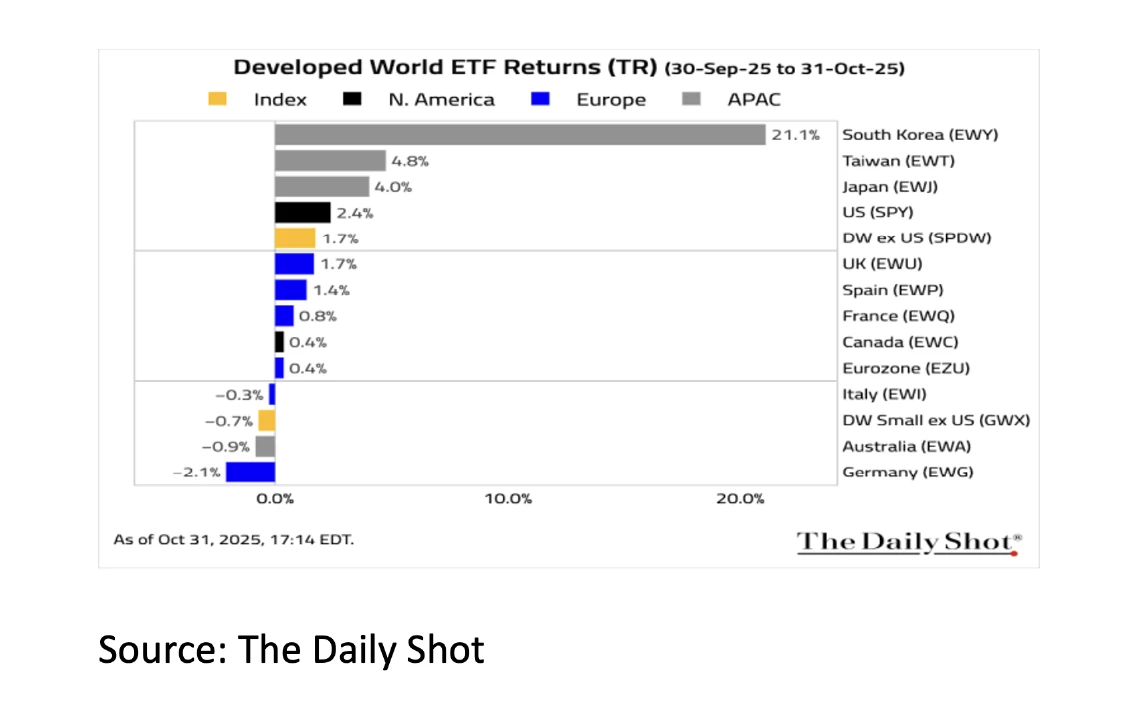

- October was another good month for investors. Equity markets (US +2.4% in USD) rose and capital market interest rates (UST10yr -5bp) fell.

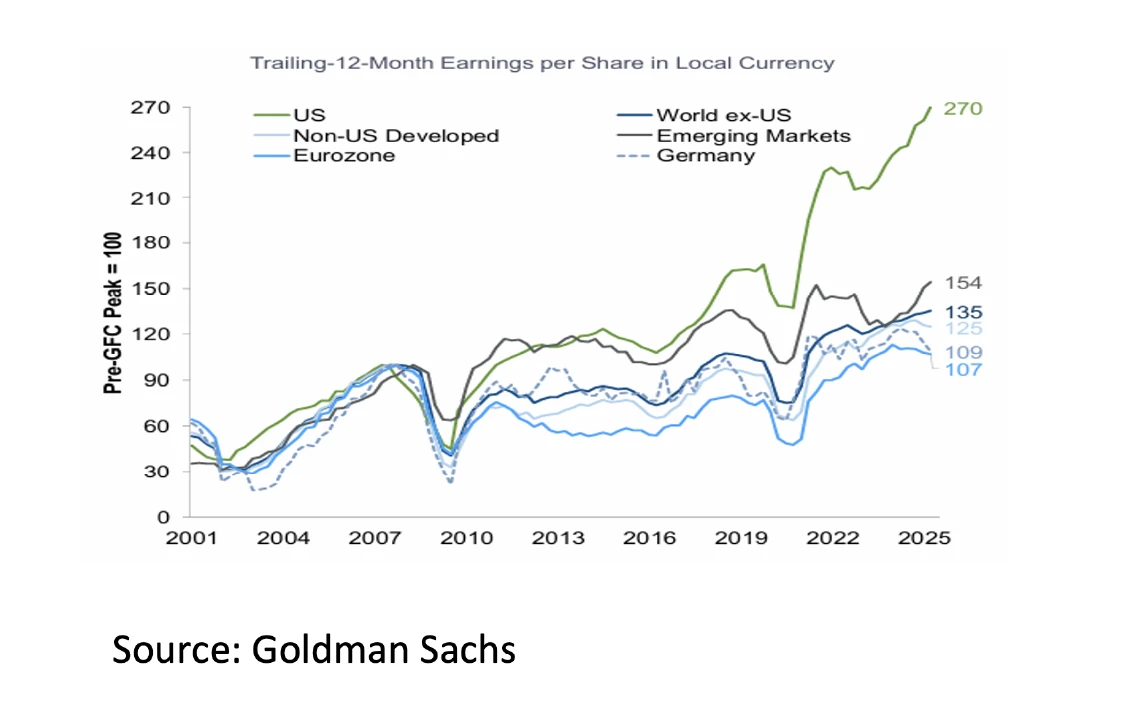

- While US stocks are historically and relatively expensive, the current profitability and innovative power of American business should not be underestimated. It is a trend that has been going on for quite some time and shows no signs of stopping.

Despite the fact that stock markets are breaking records almost daily, there are still plenty of worrying developments. For example, the US has never experienced a government shutdown of such duration, and although government data is therefore unavailable, the available ADP figures clearly show that the US labor market is deteriorating further. In Germany, the manufacturing sector has been in recession for a record 40 months, and the economy has grown in only two of the last 12 quarters. Furthermore, there's been a lot of talk lately about France's national debt, but we're seeing rapid increases in almost all Western countries, and inflation remains structurally (too) high in the US, the EU, and the UK.

Yet, there are still positive (economic) developments. For example, the Atlanta Fed expects US economic growth to be as high as +4% (annualized) in 25Q3. Furthermore, the Fed lowered interest rates again by 0.25% to 4% at the end of October, and further interest rate cuts cannot be ruled out. According to the Fed model, current financial conditions are "the most accommodative since early 2022." It is also positive that the current capex boom in artificial intelligence, unlike previous capex booms, is largely financed by companies' own cash flow and not by borrowed money. This makes the capex boom in artificial intelligence incomparable to the capex boom during the dot-com bubble of the late 1990s that led to the Dot Com crisis at the beginning of this century. The positive impact of AI on labor productivity, and thus on economic growth, will gradually become clearer in the coming years and will profoundly change our lives.

October was another good month for investors. Equity markets (US +2.4% in USD) continued to rise, while capital market interest rates (UST10yr -5bp) fell. Gold (+3.5%) also continued to rise in value, despite a sharp correction at the end of the month. Although US corporate profits have been rising uninterruptedly since 2020Q3, exceeding analyst expectations every quarter, US stocks are expensive, both relatively and historically. For investors with a fear of heights, it might therefore be advisable to invest in the stock markets of Asia, the UK, the EU, or EM. However, the profitability and innovative power of American businesses should not be underestimated. It's a trend that has been ongoing for quite some time and shows no signs of abating.

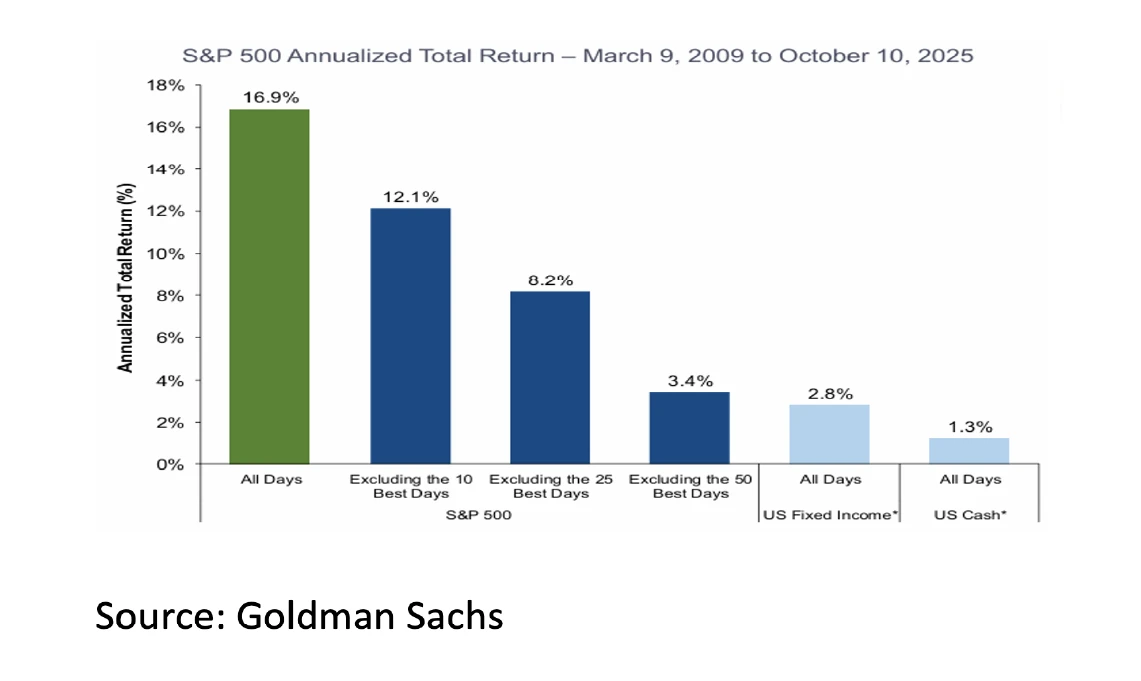

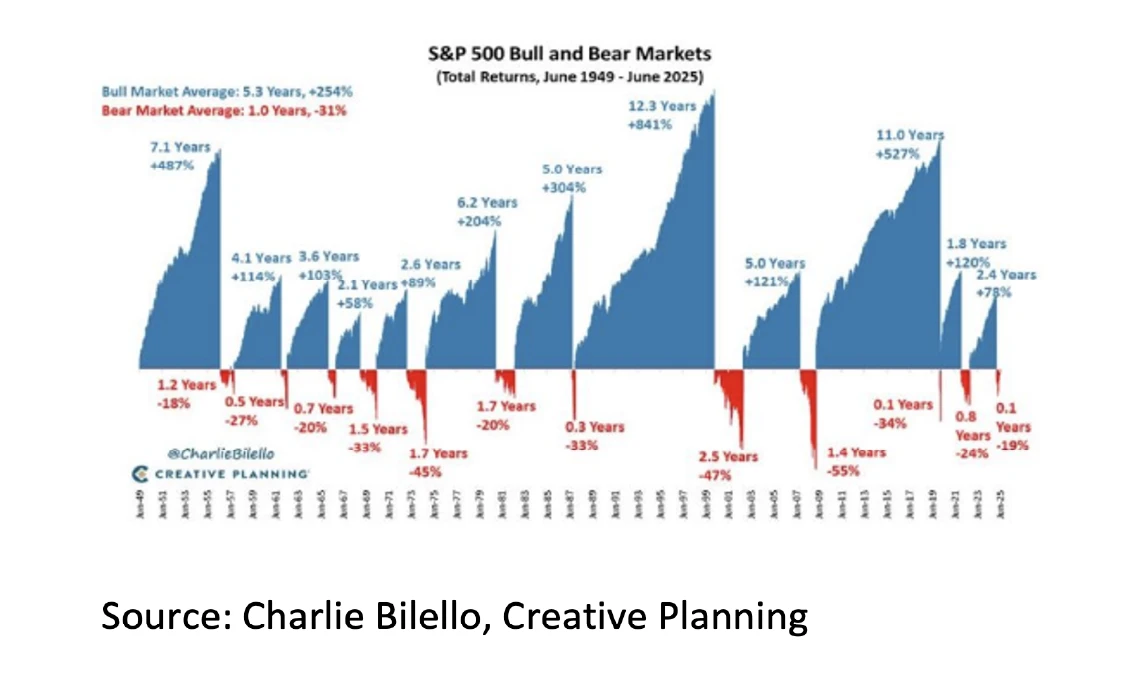

Furthermore, we do not advocate trading and timing markets. Firstly, few investors appear to be consistently successful at it. Secondly, since the current bull market began on March 9, 2009, the annualized total return on the S&P 500 has been +16.9%. Those who missed the best 50 of these 4,330 days (1.2%) achieved an annualized total return of "only" +3.4%. To those who fear a correction, we want to say: bear markets usually come unexpectedly and, on average, don't last very long. It's better to assume a bull market, stay focused on the long term, and ensure that the inevitable bear market can be ridden out and viewed as a good buying opportunity. Controlling your nerves and avoiding excessive leverage in your portfolio are crucial in this regard.

Disclaimer:

While the information contained in the document has been formulated with all due care, it is provided by for information purposes only and does not constitute a professional advice. We would encourage you to seek appropriate professional advice before considering a transaction as described in this document. No liability is accepted whatsoever for any direct or consequential loss arising from the use of this document.