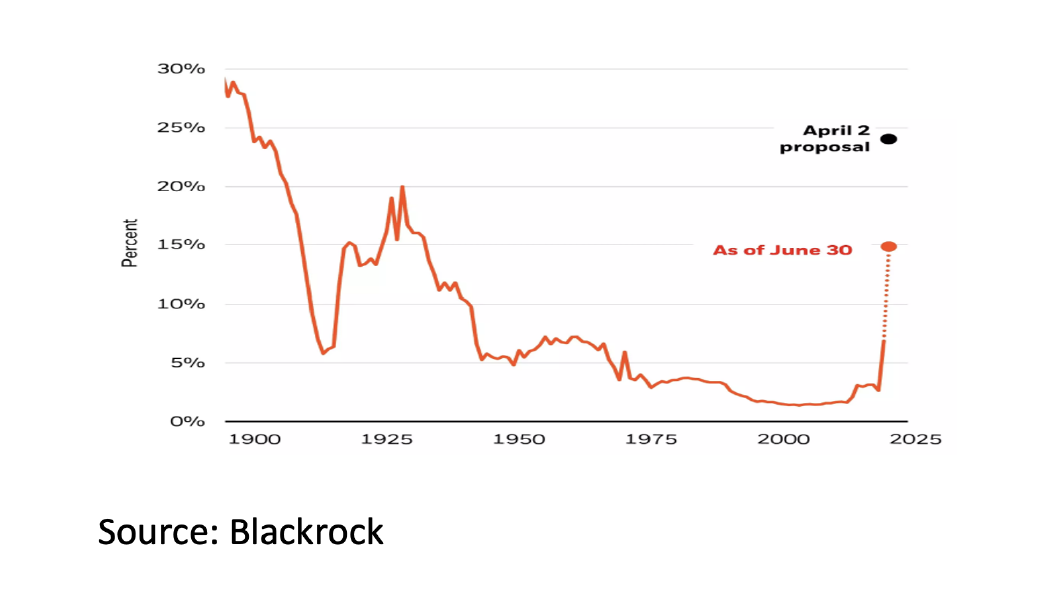

- The second quarter of 2025 started with great turmoil when President Trump announced his “reciprocal tariffs” on April 2. Many countries have now been able to reach a deal with the US and the potential increase has been halved.

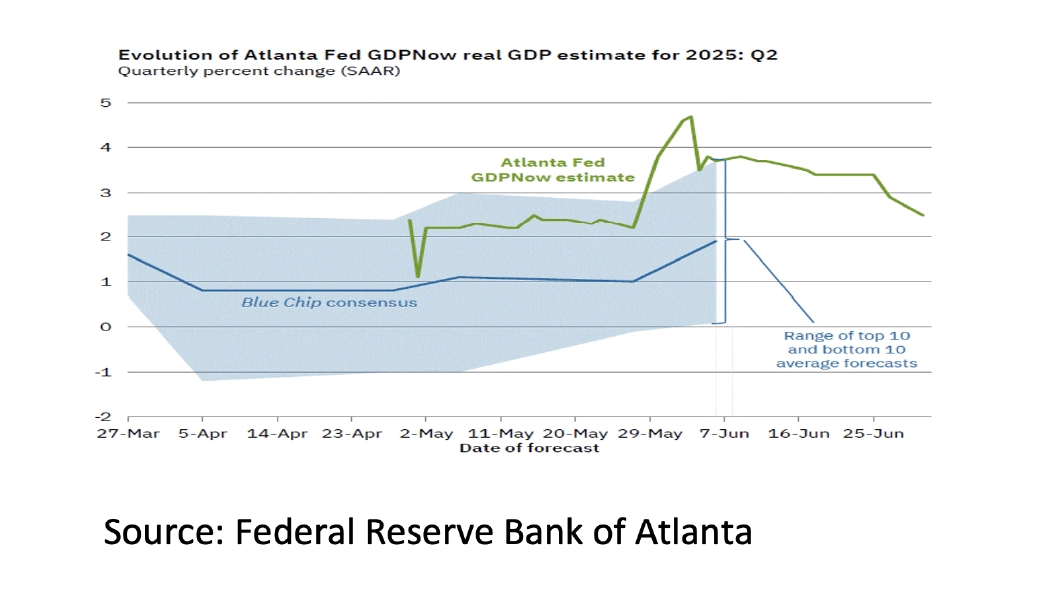

- According to ABNAMRO, there was a small contraction in the Eurozone in 2025Q2 (-0.2% qoq) and according to the Atlanta FED there was surprisingly strong growth in the US (+2.5% qoq annualized).

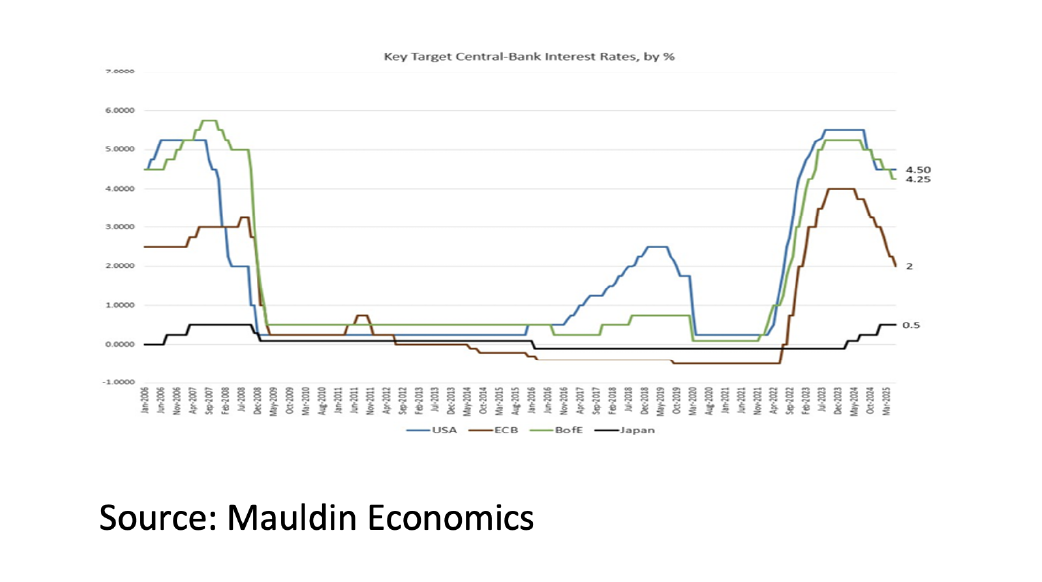

- The ECB cut interest rates again in June by 0.25% to 2.0% and is expected to cut rates twice more this year.

- In addition, Germany has announced that it will abandon the so-called “Schuldenbremse”. Germany will invest €500 billion in infrastructure over the next 10 years and, like other countries in the EU (except Spain), will significantly increase defense spending.

- Unlike the ECB, the FED did not lower interest rates again and they remained relatively high at 4.5%. There is enough room for the FED to lower interest rates substantially if necessary. The pressure to do so from President Trump will increase significantly in the coming period.

- “Bull Markets climb a wall of worry” and “Bear Markets slide down a river of hope”. 2025H1 was no exception. With the war in Ukraine, the Israel/Gaza conflict, President Trump's "reciprocal tariffs" and the Israeli-US attack on Iran, there was plenty “to worry” about.

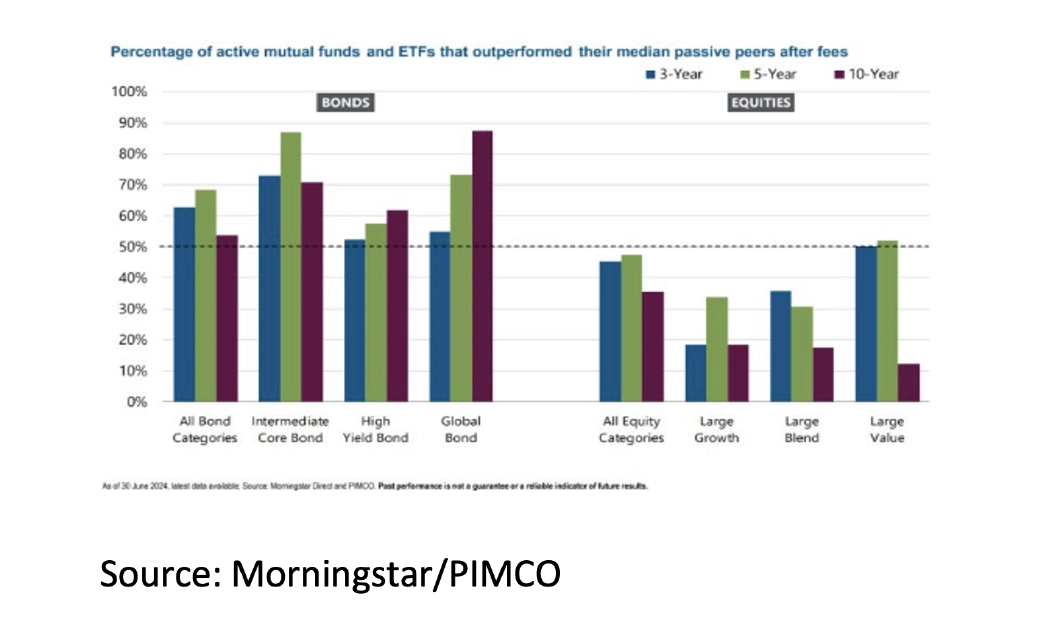

- On both 3, 5, and 10-year track records, there are only a few equity investors who structurally succeed in outperforming the benchmark. Passive investing in an index therefore still seems preferable.

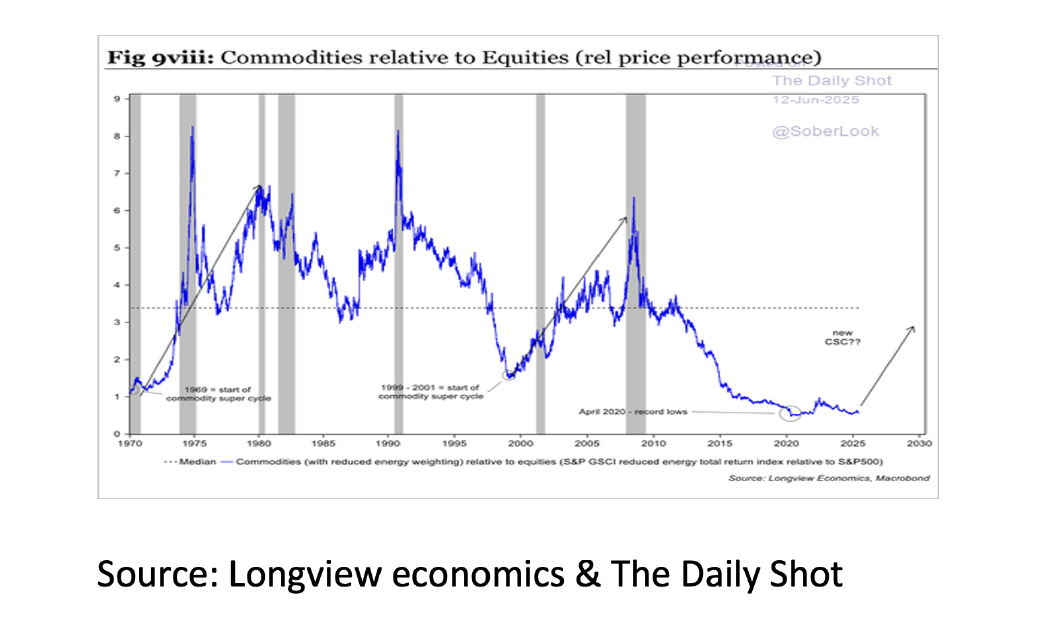

- The enormous underperformance of Commodities compared to equities remains remarkable. With all the unrest in the world, a new Commodity Super Cycle cannot be ruled out.

The second quarter of 2025 started with great turmoil when President Trump announced his “reciprocal tariffs” on April 2. Many countries have since been able to reach a deal with the US and the potential increase has been halved. While in 25Q1 the the Eurozone economy (+0.6% qoq) benefited and the US economy (-0.5% qoq annualized) suffered when US companies quickly increased their imports, the opposite was true in 25Q2. According to ABNAMRO, the normalization led to a small contraction in the Eurozone (-0.2% qoq) in 25Q2 and surprisingly strong growth in the US (+2.5% qoq annualized) according to the Atlanta FED.

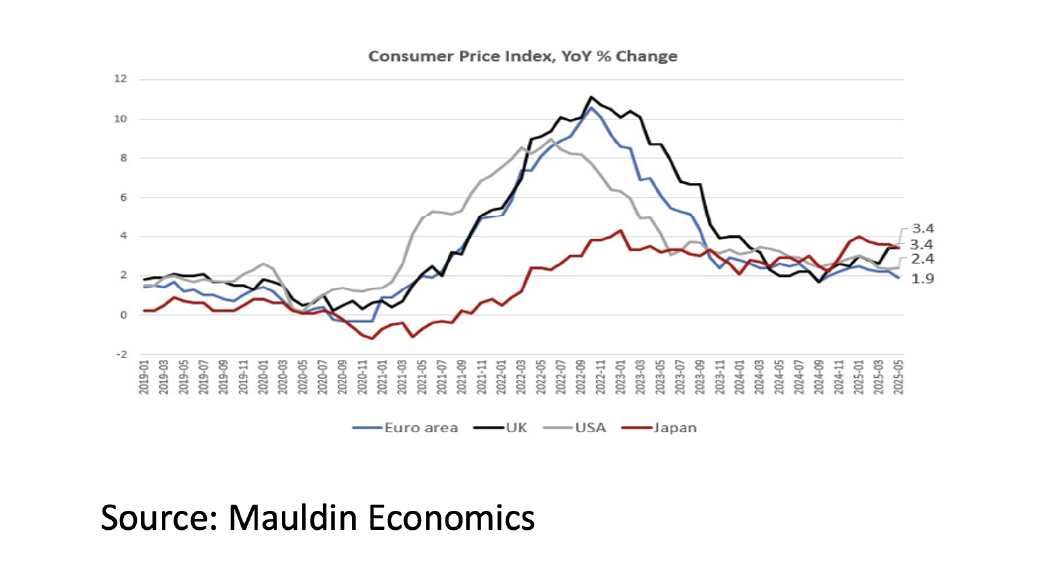

Although economic growth in the Eurozone was disappointing in 25Q2, the outlook has gradually improved. The ECB cut interest rates again in June by 0.25% to 2.0% and is expected to cut rates twice more this year. In addition, Germany has announced that it will abandon the so-called “Schuldenbremse”. For example, it will invest €500 billion in infrastructure over the next 10 years and, like the other countries in the EU (except Spain), it will significantly increase defense spending. In contrast to the ECB, the FED did not cut interest rates again and kept them relatively high at 4.5%. On the one hand, this is understandable because the US economy still seems quite healthy. On the other hand, inflation in the US at 2.4% is considerably lower than that in Japan (3.4%) while the BoJ kept the interest rate at 0.5% and the FED rate is the same as that of the BoE while inflation in the UK is 1.0% higher. Also compared to the ECB, the 2.5% higher FED interest rate cannot be explained by the 0.5% higher inflation. There is therefore room for the FED to lower the interest rate significantly, if necessary. The pressure to do so from President Trump will increase significantly in the coming months.

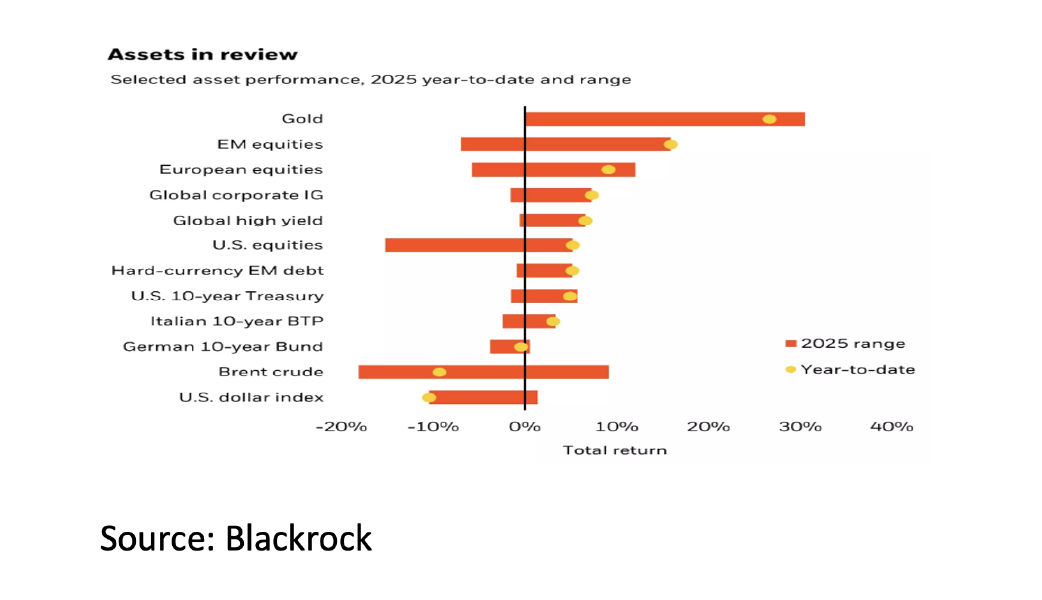

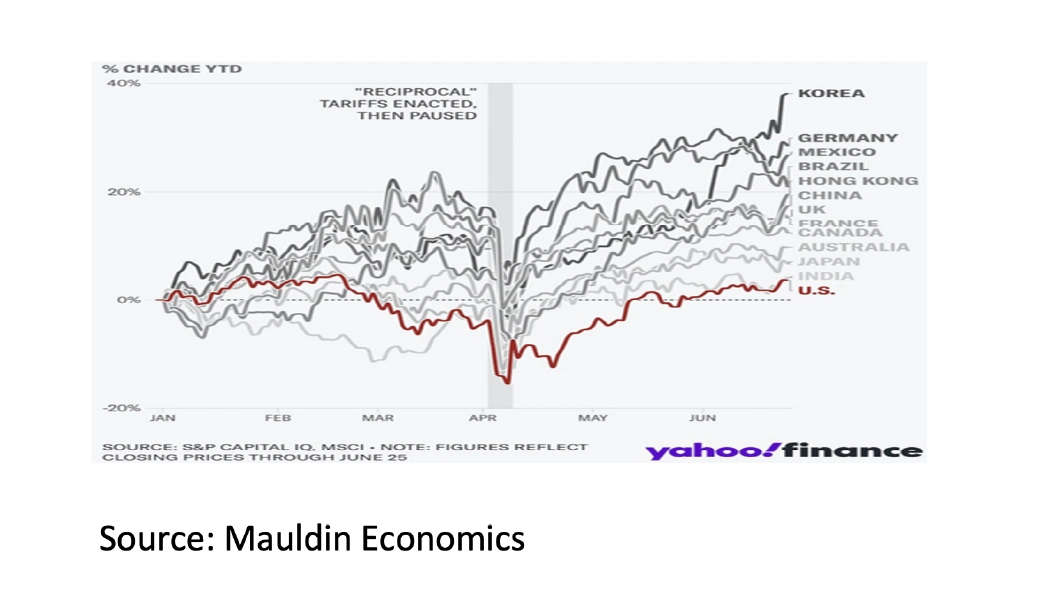

It is often said that “Bull Markets climb a wall of worry” and “Bear Markets slide down a river of hope”. In that respect, the first half of 2025 was no exception. With the exception of Brent Crude, 10yr Bunds and the USD, almost all assets showed a positive return in local currency in 2025H1. This while there was enough reason to be concerned. For example, there was the ongoing war in Ukraine, the ongoing Israel/Gaza conflict, the unrest that President Trump managed to create with his “reciprocal tariffs” and the attack of Israel and the US on Iran. What was also notable in 2025H1 was that there seems to have been an (temporary) end to the hegemony of American equities. After a huge outperformance of American equities since 2009, the S&P 500 significantly lags other equity markets (in USD) in 2025H1.

Since there is still plenty to “climb the wall of worry”, the Central Banks will continue to lower interest rates in September, a recession does not seem imminent and the S&P 500 has not shown a negative return in July for 10 years, there are still plenty of reasons to remain moderately positive on equities. Although it remains useful for bond investors to select an active manager for this, this does not appear to be the case for equity investors. Both on a 3, 5 and 10-year track record, there are only a few managers who structurally succeed in outperforming the benchmark. Index investing in equities therefore still seems advisable. The enormous underperformance of Commodities compared to equities remains remarkable. With all the unrest in the world, a new Commodity Super Cycle cannot be ruled out.

Disclaimer:

While the information contained in the document has been formulated with all due care, it is provided by for information purposes only and does not constitute a professional advice. We would encourage you to seek appropriate professional advice before considering a transaction as described in this document. No liability is accepted whatsoever for any direct or consequential loss arising from the use of this document.