- President Trump has nominated Kevin Warsh to succeed Jerome Powell as Fed chairman. He appears, more than Powell, to be a Fed chairman willing to listen to President Trump's "advice".

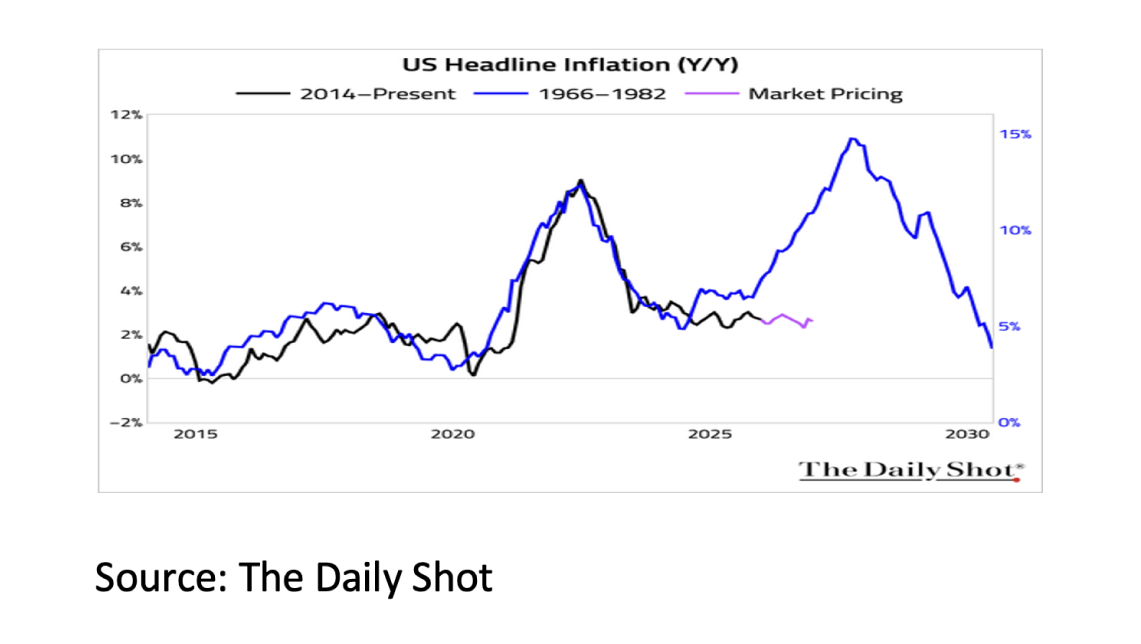

- Although the Fed has now managed to reduce inflation from a peak of 9% in 2022 to 2.7% at the end of 2025, inflation is still too high.

- The fact that the financial markets expect two interest rate cuts from the Fed this year is therefore not because inflation is already sufficiently under control in the US.

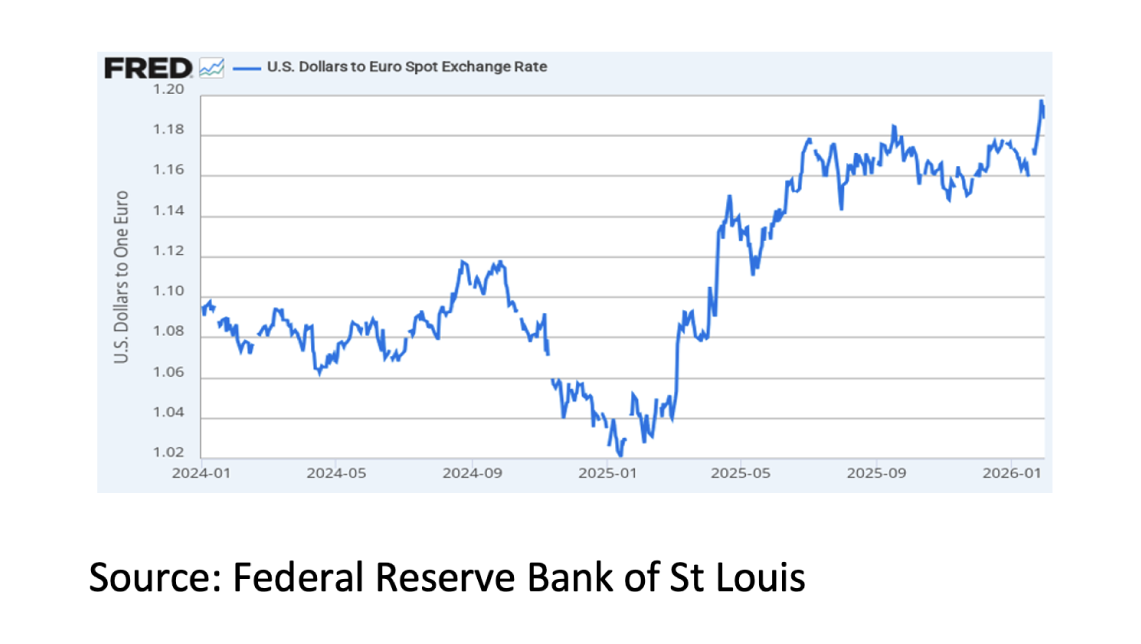

- The decline of the USD against the Euro since the beginning of 2025 cannot be seen in isolation from this. There are growing fears that the Fed is losing its independence under President Trump.

- In addition, it is also important that President Trump suddenly says he is in favor of a lower USD, which also is still highly overvalued based on Purchasing Power Parity, and both the US and the USD are increasingly seen as a risk due to President Trump's policies.

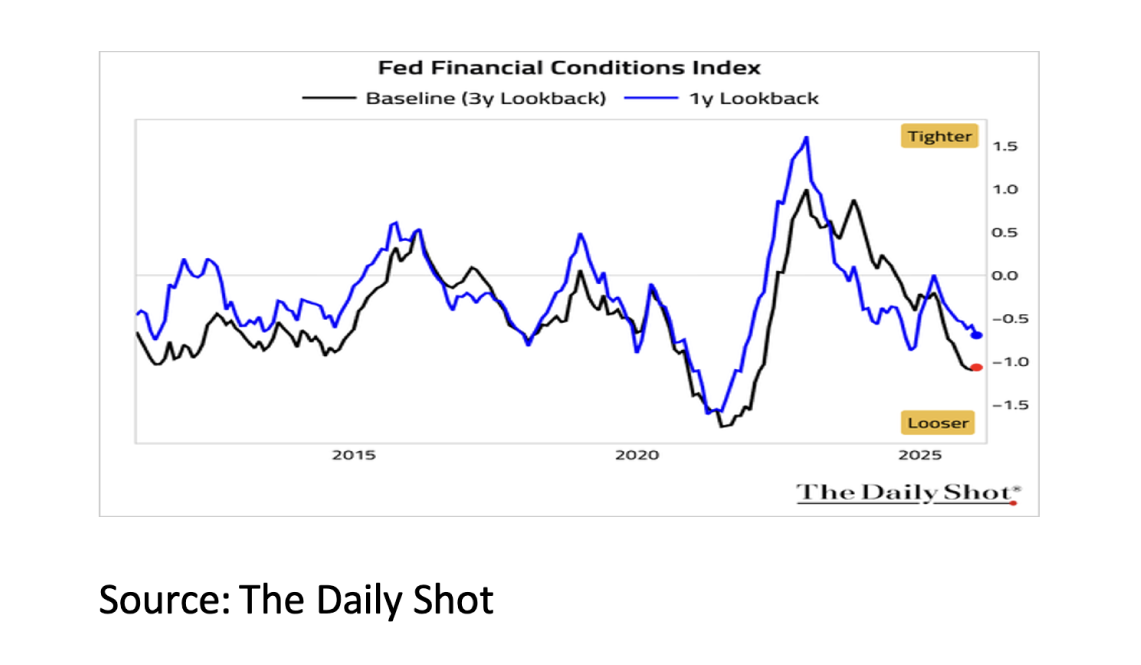

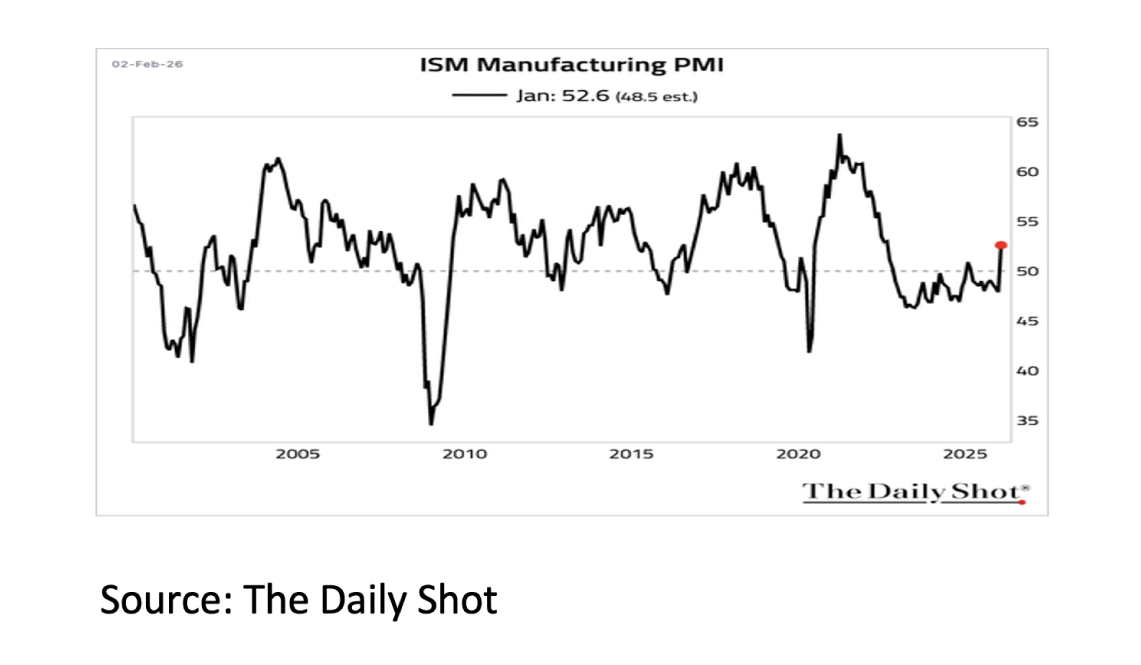

- Positive for the US economy in 2026 are the still very loose “financial conditions” index and the increase in the ISM manufacturing index.

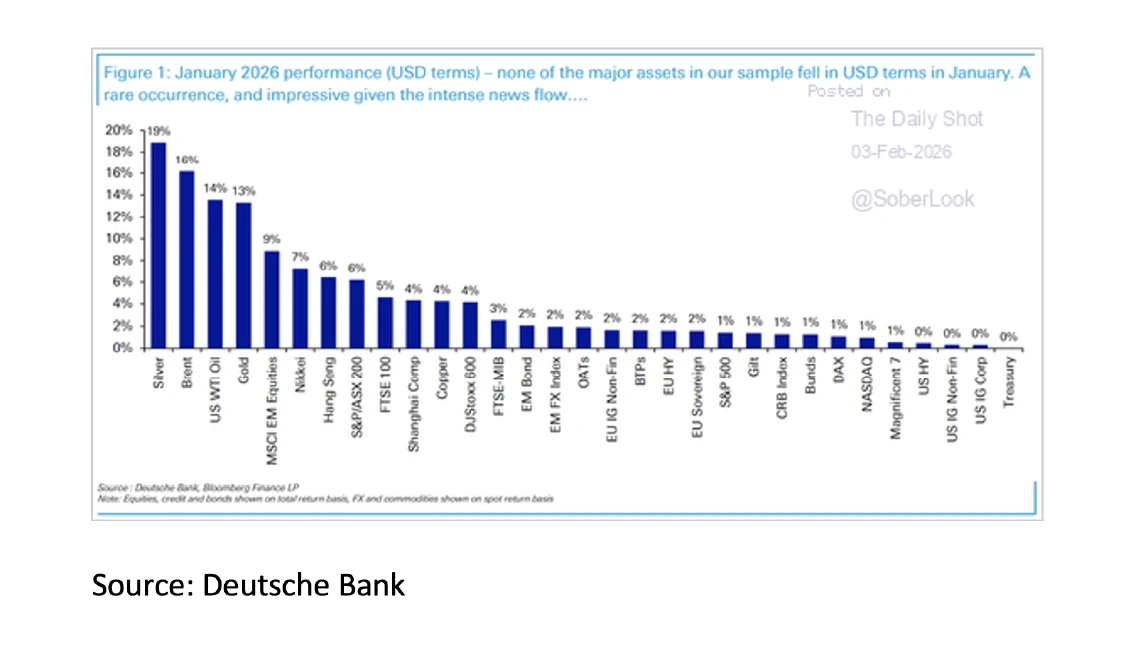

- Despite all the geopolitical unrest and volatility in the financial markets, January was a particularly good month for investors.

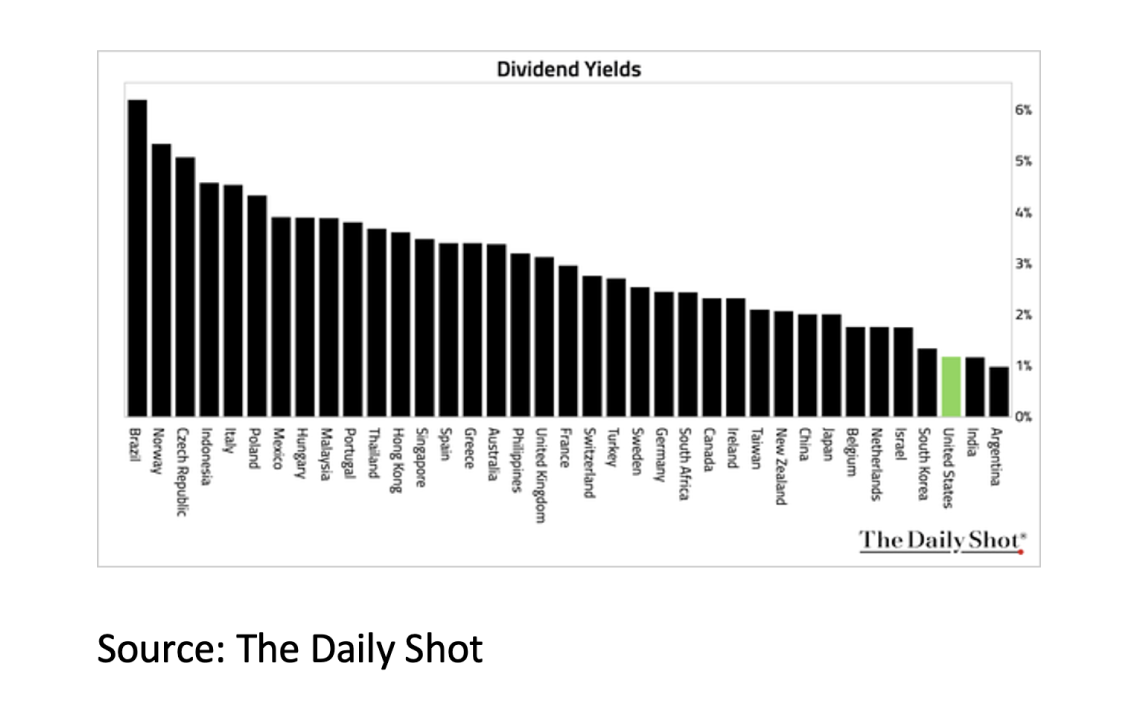

- While the outlook for both the U.S. economy and corporate earnings remains favorable, the P/E ratio of stocks in the S&P 500 is high both relative to other stock markets and relative to its own history.

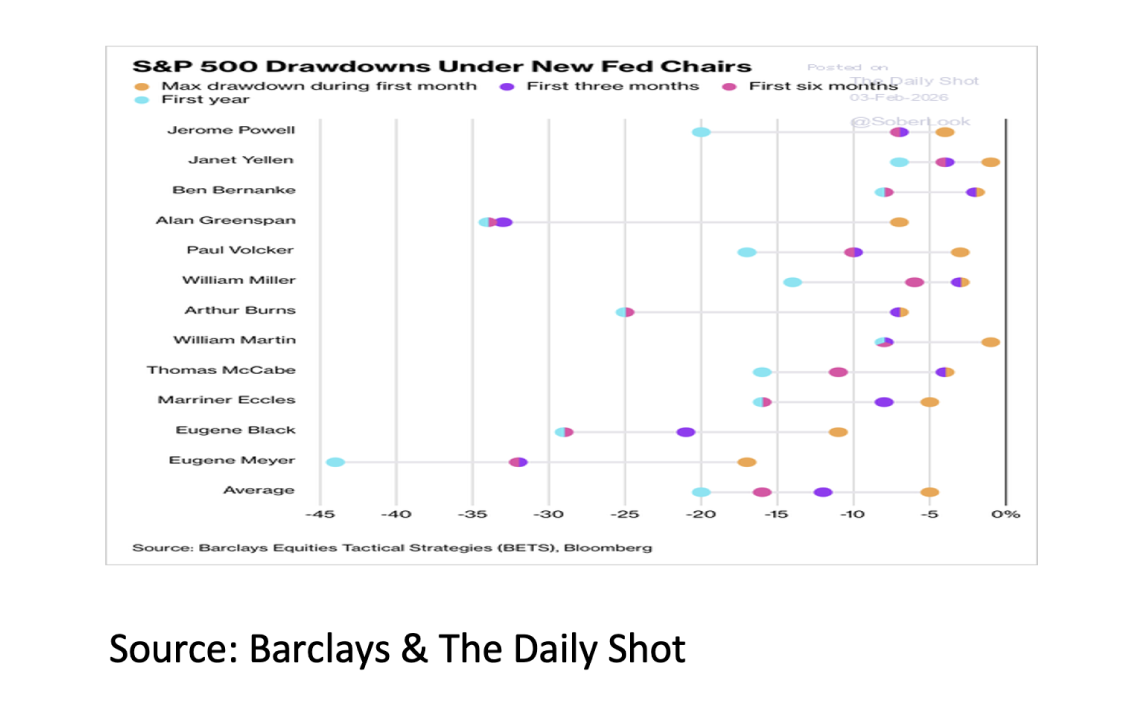

- According to Barclays, since 1930 the S&P 500 index has posted average declines of 5%, 12%, 16% and 20% in the one-, three-, six- and 12-month periods after a new Fed chairman took office.

President Trump has nominated Kevin Warsh to succeed Jerome Powell as Fed chairman. The nomination still needs to be confirmed by the US Senate, but Warsh is expected to take office as the new Fed chairman in mid-May 2026. In the past, Warsh has been both a "hawk" and a "dove" when it comes to interest rate decisions. For a good Fed Governor, this decision usually depends on the level of inflation. For Warsh, this previously seemed to depend partly on who was President. For example, he was a "dove" during both the first and second terms of Republican President Trump and a "hawk" during the term of Democratic President Biden. Therefore, Warsh, more than Powell, appears to be a Fed chairman willing to listen to President Trump's "advice." Although the Fed has now succeeded in reducing inflation from a summer peak of 9% in 2022 to 2.7% by the end of 2025, and there appears to be no repeat of the 1970s, inflation is still too high. The fact that financial markets expect two interest rate cuts from the Fed this year is therefore not because inflation is already sufficiently under control in the US.

The decline of the USD against the euro since early 2025 cannot be seen in isolation from this. There are growing fears that the Fed is losing its independence under President Trump and that politics, rather than economics, will increasingly dominate Fed policy. Furthermore, President Trump's sudden proclamation of a lower USD plays a role, the USD also remains significantly overvalued based on Purchasing Power Parity, and both the US and the USD are increasingly seen as a risk due to President Trump's policies. However, the still very accommodative "financial conditions" index and the rise in the ISM Manufacturing Index are positive for the US economy in 2026.

Despite all the geopolitical unrest and volatility in the financial markets, January was a particularly good month for investors. Virtually all assets increased in value. Metals such as silver and gold, oil, and emerging market equities rose significantly. Silver and gold benefited particularly from the ever-increasing government debt and President Trump's foreign policy. As a result, both government bonds and the USD appear increasingly less able to function as safe havens. Oil rose particularly due to the rising tensions between Iran and the US. Emerging markets benefited from the positive economic outlook and the undervaluation relative to US equities.

While the outlook for both the US economy and corporate profits remains favorable, the P/E ratio of stocks in the S&P 500 is high both relative to other stock markets and relative to its own history. Moreover, the dividend yield is also almost nowhere else in the world as low as in the US. Finally, with the arrival of a new Fed chairman in May, it might be wise to be careful for a moment and to consider a historical fact. According to Barclays, since 1930, the S&P 500 index has shown average declines of 5%, 12%, 16%, and 20% in the periods of one, three, six, and twelve months after a new Fed chairman took office. Under current Fed Chairman Jerome Powell, the S&P 500 also fell by as much as 20% at the end of that year after his appointment on February 5, 2018.

Disclaimer:

While the information contained in the document has been formulated with all due care, it is provided by for information purposes only and does not constitute a professional advice. We would encourage you to seek appropriate professional advice before considering a transaction as described in this document. No liability is accepted whatsoever for any direct or consequential loss arising from the use of this document.