- After stock markets showed a major correction in mid-November, fears of a recession in the US and/or Europe in 2026 increased.

- However, we continue to believe that the fundamentals behind current economic growth are still good.

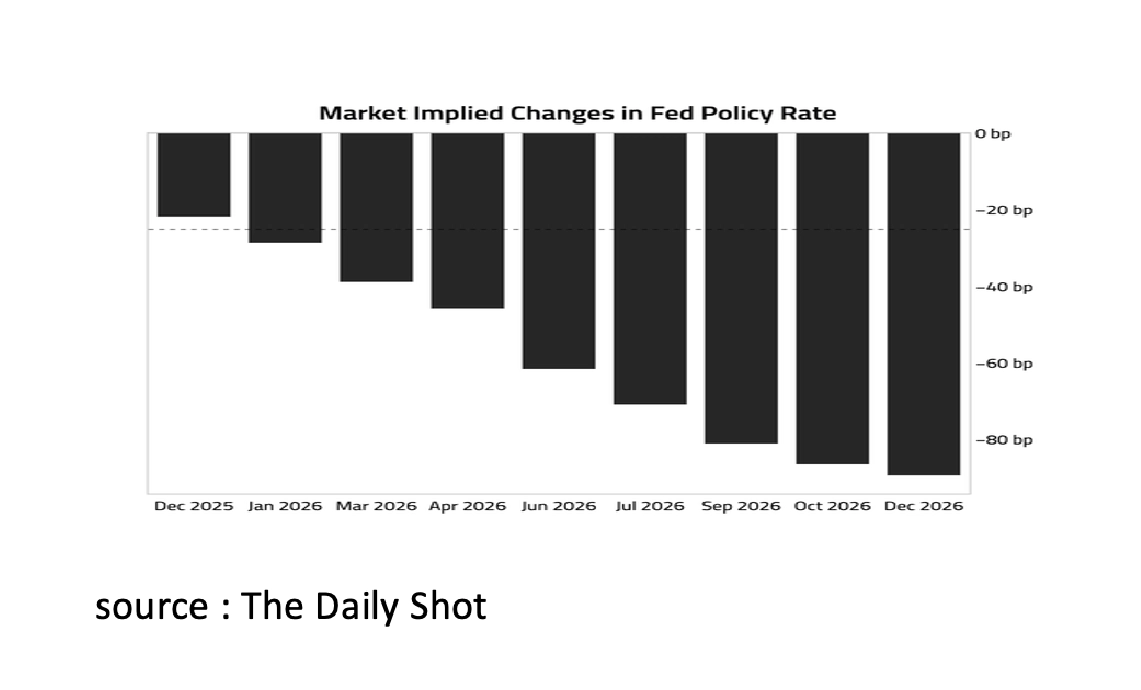

- First of all, central bank monetary policy remains accommodative for the time being. Not only is current monetary policy already considered accommodative, but the Fed is expected to cut interest rates further by at least 75bp between now and the end of 2026.

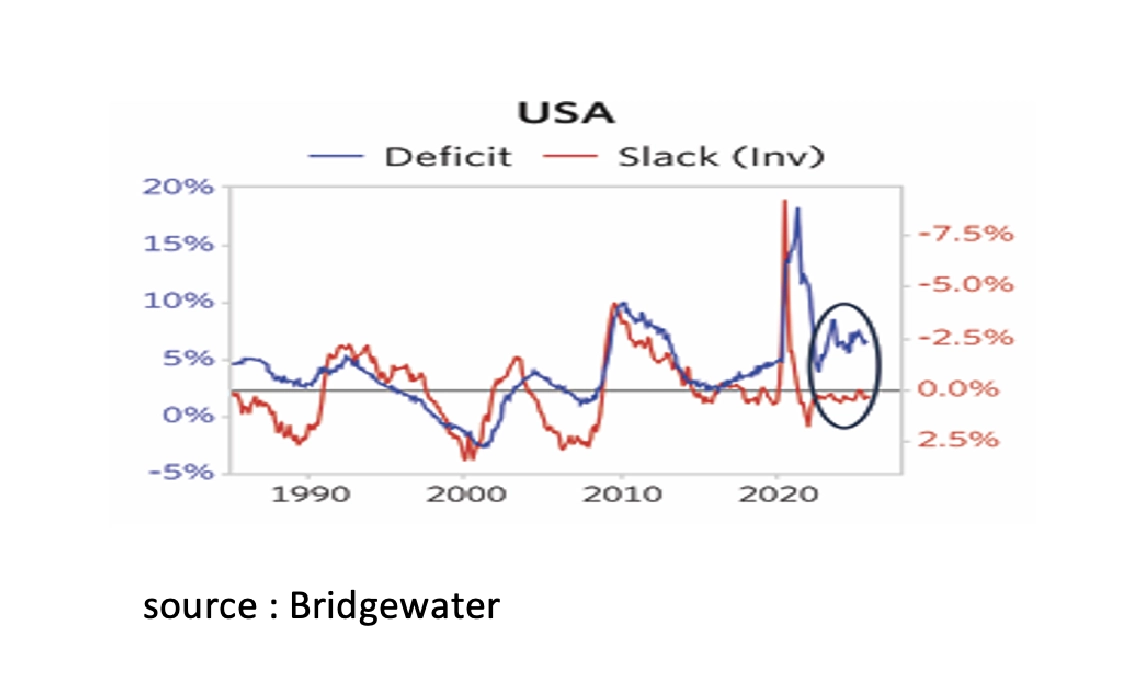

- In addition, governments in both the US and Europe are still pursuing loose fiscal policies. While this is negative for the inflation outlook, it is positive for economic growth.

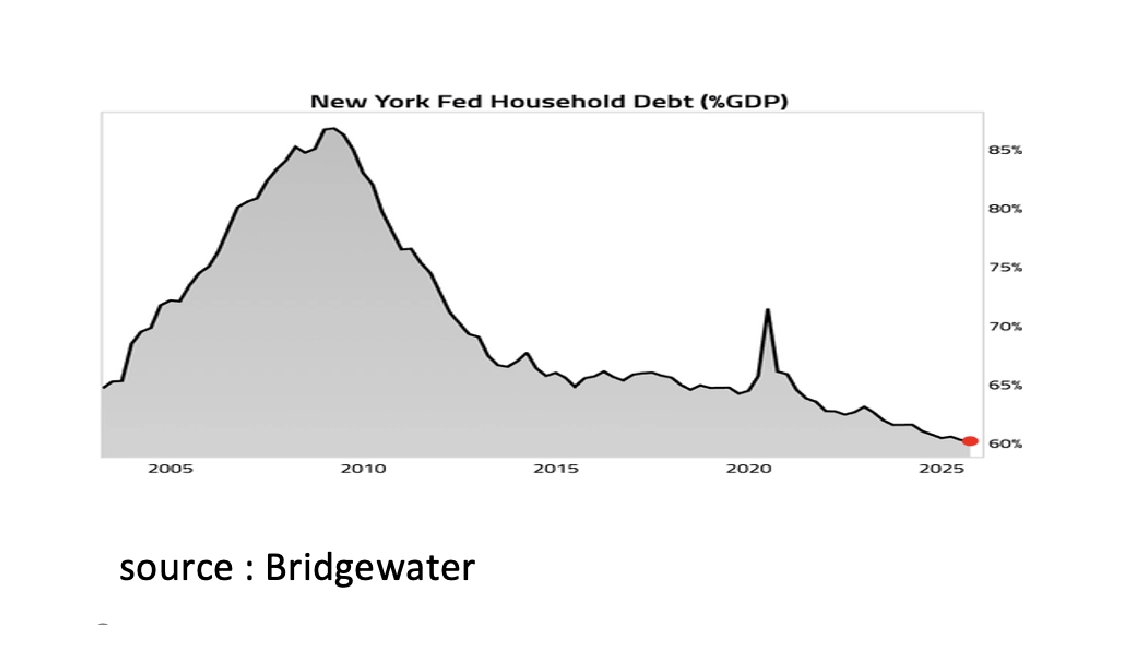

- Both companies and households, unlike governments, have significantly reduced their debt levels in recent years, which is positive for the outlook for both investment and consumption.

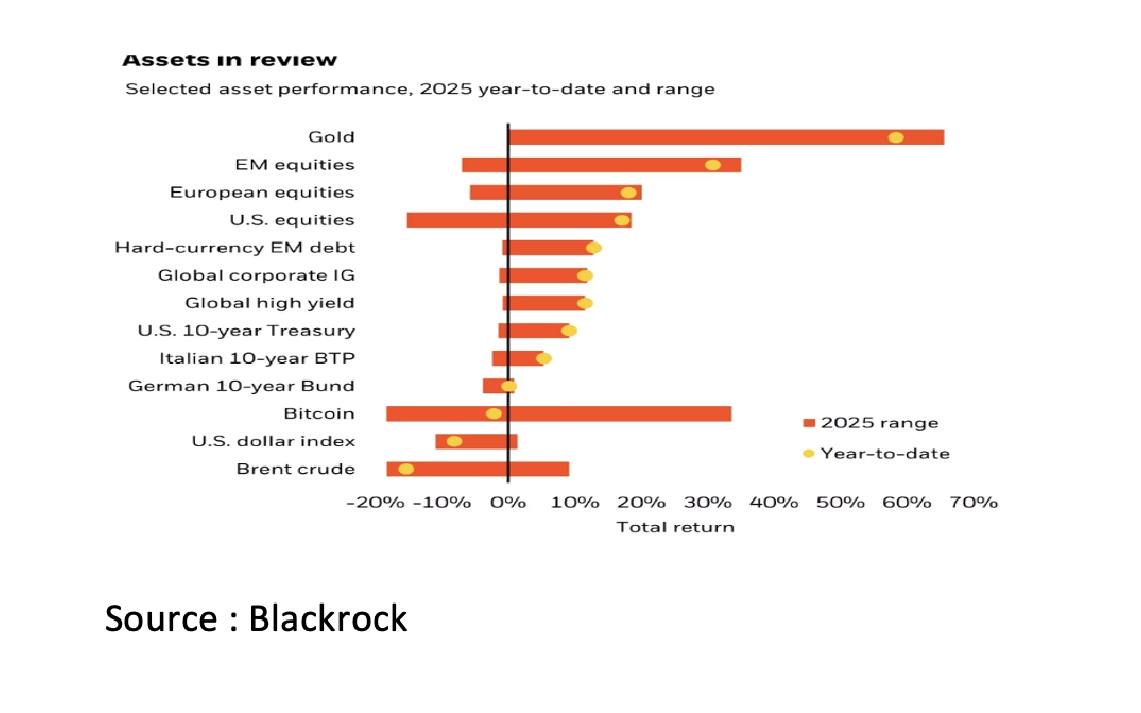

- Despite all the unrest in the financial markets in March, April, and November, panic has once again proven to be a bad advisor this year. Almost all assets achieved positive returns (year-to-date in local currency).

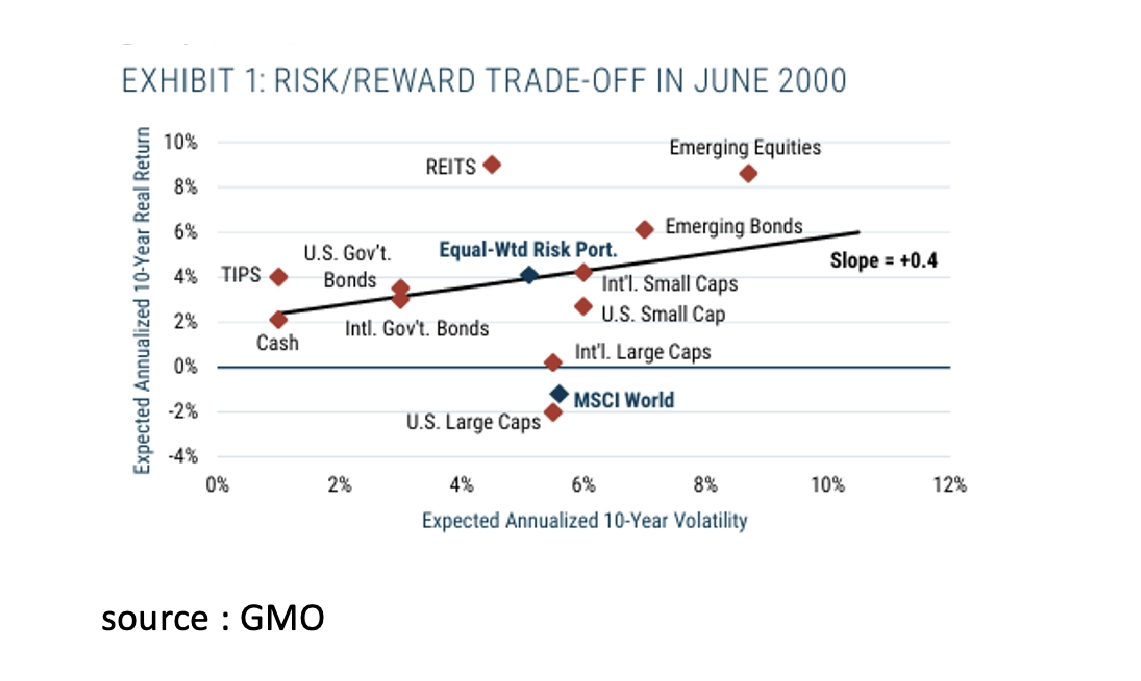

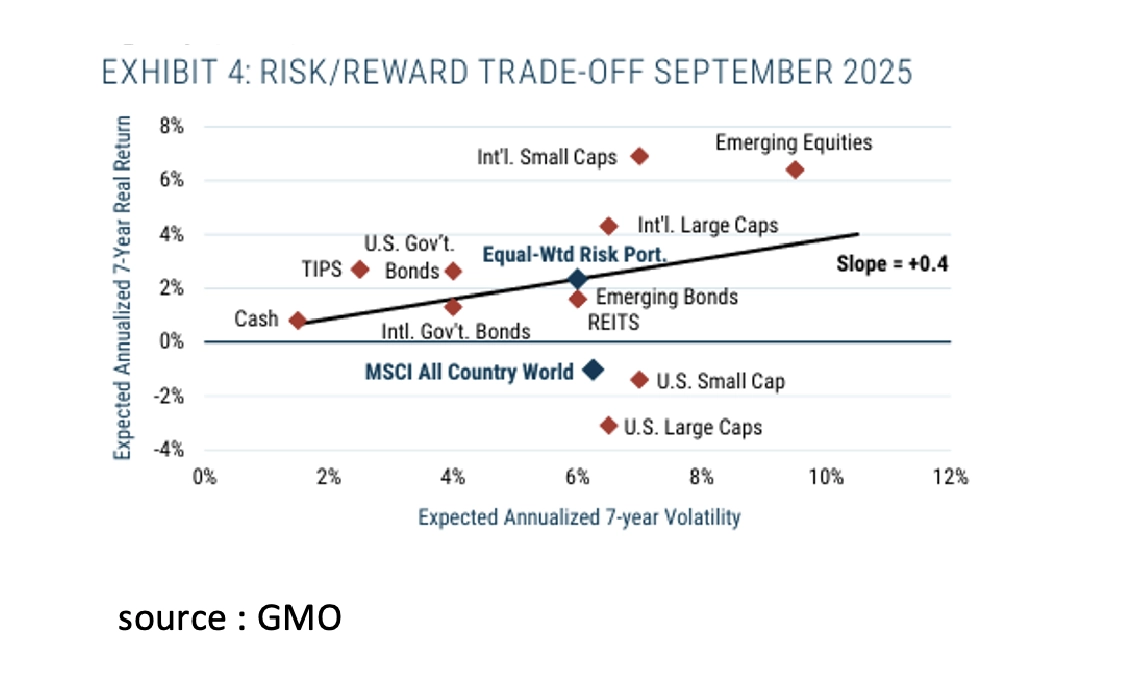

- Although we believe that the current wave of investment in AI is incomparable to the internet bubble around the turn of the century, it is now possible to build an attractive long-term stock portfolio without expensive AI stocks.

- Today, non-US stocks offer a significantly better risk/reward trade-off for a long-term investor than US stocks. Emerging Market Equities and non-US Large and Small Caps are an attractive alternative to expensive US Large Cap stocks.

After stock markets experienced a significant correction in mid-November, the similarities between the current wave of investment in Artificial Intelligence (AI) and the Dot Com crisis just after the turn of the century were widely noted. Fears of a recession in the US and/or Europe in 2026 also increased. However, we continue to believe that the fundamentals behind the current economic growth remain sound. First of all, the monetary policy of the central banks remains accommodative for the time being. Not only is the current monetary policy already considered accommodative, but the Fed is expected to further cut interest rates by at least 75bp between now and the end of 2026. Furthermore, governments, both in the US and in Europe, are still pursuing accommodative fiscal policies. Unlike previous economic cycles, governments are pursuing pro-cyclical rather than counter-cyclical policies. In the past, governments would spend extra money when the private sector was experiencing overcapacity, and vice versa. That is not the case this time. Governments are spending more even though there is no excess capacity in the private sector. While this negatively impacts inflation prospects, it is positive for economic growth.

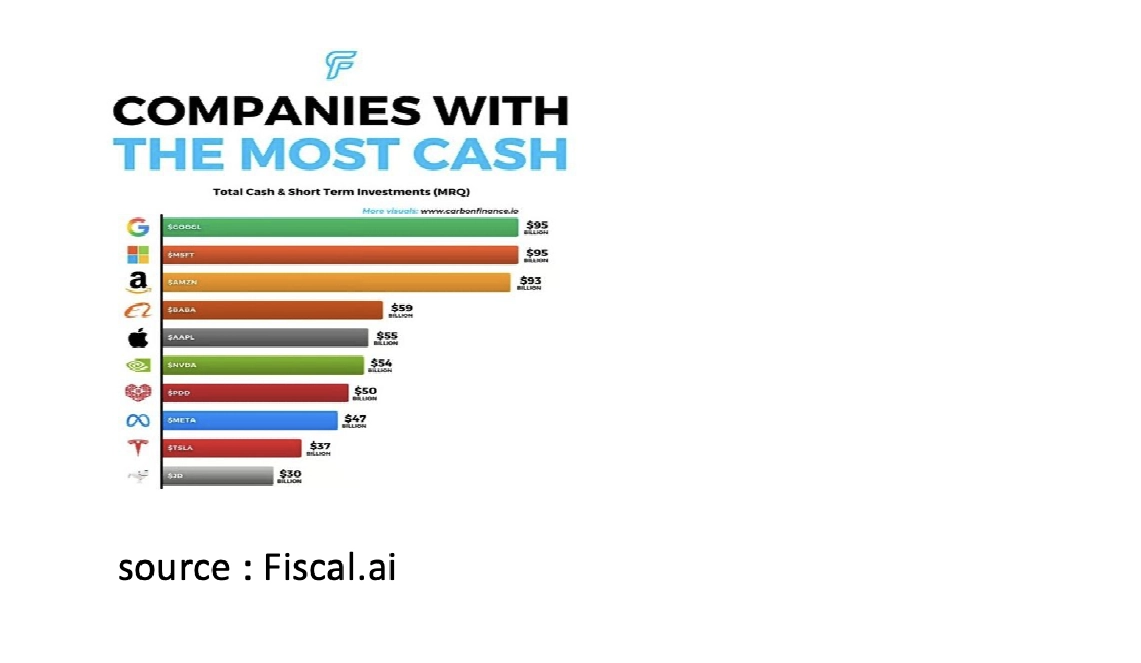

Looking at the private sector, we see that both companies and households, unlike governments, have significantly reduced their debt in recent years. Current AI companies are often already profitable, and investments have, so far, been largely financed from their own cash flow and not exclusively with borrowed money, as in the dot-com bubble. The capex boom in AI is therefore incomparable to the capex boom during the internet bubble in the late 1990s that led to the dot-com crisis in the early 2000s. Households are also in relatively good shape, which is positive for the outlook for consumption.

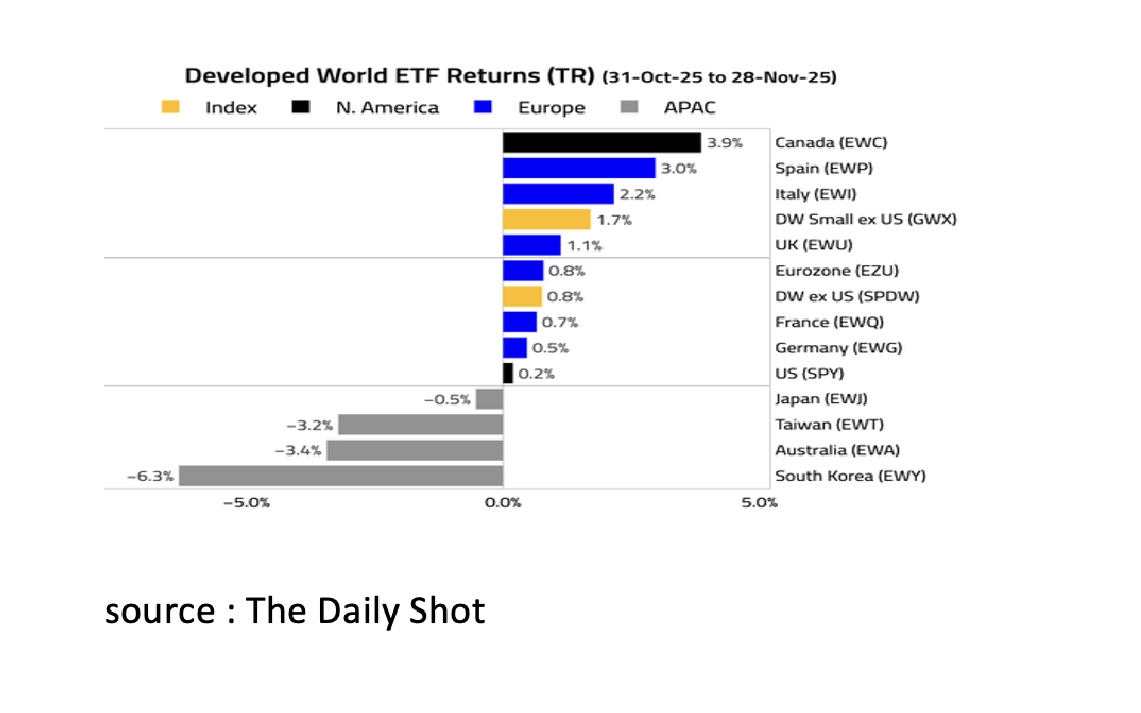

Despite all the turmoil in the financial markets this year, with significant stock market corrections in March, April, and November, panic is once again proving a poor advisor. With the exception of Bitcoin and Brent Crude, almost all assets (year-to-date in local currency) achieved positive returns. Even in the volatile month of November, most stock markets ultimately achieved positive returns, although many Asian stock markets were a notable exception.

With the current high valuations of AI stocks and the turmoil in the financial markets in November, a growing number of investors are wondering whether AI is now just as much of a bubble as the Dot Com bubble 25 years ago. While we believe the current wave of investment in AI is incomparable to the internet bubble around the turn of the century, it is now possible to construct an attractive long-term stock portfolio without AI stocks. Non-US stocks now offer a significantly better risk/reward trade-off for a long-term investor than US stocks. The two figures below clearly demonstrate that, just as in June 2000, US large cap stocks currently do not have an attractive risk/reward trade-off. Just as then, an equally weighted stock portfolio and emerging market equities offer a much better risk/reward trade-off than US large caps and the (market cap weighted) MSCI World. Currently, emerging market equities and non-US large and small caps appear to be an attractive alternative to expensive US large cap stocks.

Disclaimer:

While the information contained in the document has been formulated with all due care, it is provided by for information purposes only and does not constitute a professional advice. We would encourage you to seek appropriate professional advice before considering a transaction as described in this document. No liability is accepted whatsoever for any direct or consequential loss arising from the use of this document.