July 2023

In a recent move, the Monetary Authority of Singapore (MAS) tightened the criteria for family offices and their funds to qualify for the tax exemptions under sections 13O and 13U of the Income Tax Act (ITA). The new criteria are aimed at increasing the size of the funds, sharpening the fund manager's expertise and boosting investments in the local economy. What does this mean for you? In this article, we will summarize the changes in MAS' tax incentive for single family offices (SFOs) and explain the implications.

Singapore has earned a reputation as a desirable destination for high-net-worth families seeking to professionalize the management of their money. The Lion City offers tax exemptions for funds managed by Singapore-based fund managers who are licensed by the MAS. These exceptions also apply to funds managed by fund managers who are exempt from the rules. Managers of Family Offices are one such example.

The MAS says it wants its regulations, standards, and incentive systems to be in line with the goals and ambitions of family offices. It says: “As the family office eco-system in Singapore grows and matures, we seek to increase the professionalism of family office professionals in Singapore and enhance the positive spill overs to the Singapore economy.”

All new family office applications to the MAS after July 2023, will be subject to the revised standards. Applications which have been submitted earlier, will likely not be affected. Additionally, the changes do not apply to funds managed or advised by a licensed fund manager in Singapore.

Funds under 13O are Singapore-incorporated investment vehicles.

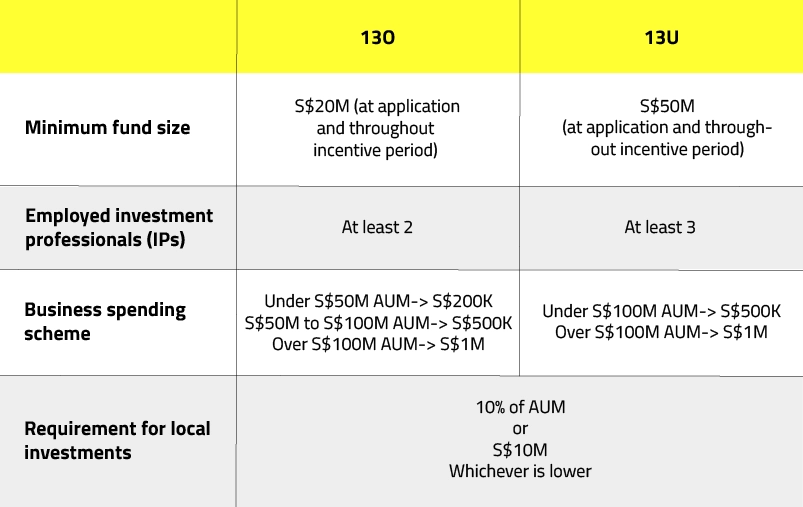

- Under section 13O, funds must now have a minimum of S$20 million at the time of application and throughout the incentive period. Additionally, MAS now mandates that funds retain the applicable minimum AUM for the entire duration of the fund in order to remain eligible for the tax incentive.

- The requirement for the number of investment professionals (“IPs”) in a family office has increased from one to two . At least one of the two IPs must be a non-family member. It is also important to note that the updated conditions place greater emphasis on IPs being tax resident in Singapore.

- Previously the minimum business spend used to be S$200,000 per year, regardless of the fund's size. Under the new criteria, the minimum of S$200,000 spend per annum is required with funds smaller than S$50M. A minimum of S$500,000 per year business spending is required when the fund size is larger than S$50M but less thanS$100M. The required business spending increase to S$1M per year when the fund size is larger than S$100M.

Funds under 13U are fund vehicles that can be constituted and maintained in Singapore or outside of the country.

- The MAS has changed the number of IPs required for section 13U funds. According to the new rules, at least one of the three IPs must be a non-family member. It is also important to note that the updated conditions place greater emphasis on IPs being tax resident in Singapore.

- Here the new minimum required business spending is set at S$500,000 per year for funds up to S$100M. Any funds larger than S$100M are required to spend at least S$1M, similar to 13O fund vehicles.

- Previously, section 13O and 13U funds were did not have to meet any geographic requirements. However, the new regulations require them to have at least 10% of the fund's AUM or S$10m (whichever is lower) invested in Singapore-based investments at any one time (including during the application process).

The following investments are eligible for the geographical requirement: (i) equities traded on Singapore-licensed exchanges; (ii) qualifying debt securities; (iii) funds provided by Singapore-licensed/registered fund managers; (iv) private equity investments into non-listed Singapore- incorporated firms, such as start-ups; (v) Climate related investments;and (vi) Blended finance setups with susbstantial involvement from Singapore-licensed or registered financial institutions

An overview of all changes in one table:

Trustmoore is an experienced provider of Private Clients services, and we have been in the business for over 20 years. We understand that every family office setup can be unique that is why our tailored solutions are designed to suit your specific needs.

As we are independent of any bank, law firm or accounting practice, we are well placed to focus exclusively on the setup and ongoing administration of your family office in Singapore. Our role is to guide you through operational matters such as structuring, regulatory compliance, and the application of tax incentives