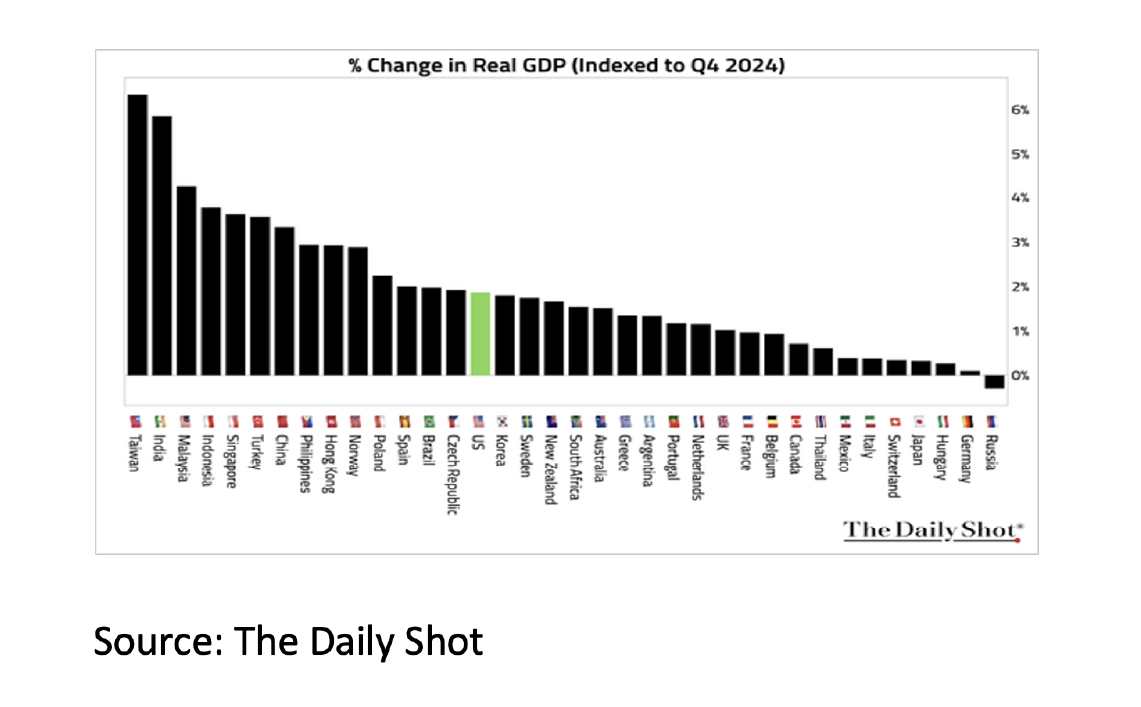

- Despite the many geopolitical problems, economic growth in 2025 was higher than expected in many countries and sometimes even slightly higher than in 2024.

- Noteworthy was the negative economic growth in the US in 2025Q1 which was a consequence of the “war on tariffs” announced by President Trump.

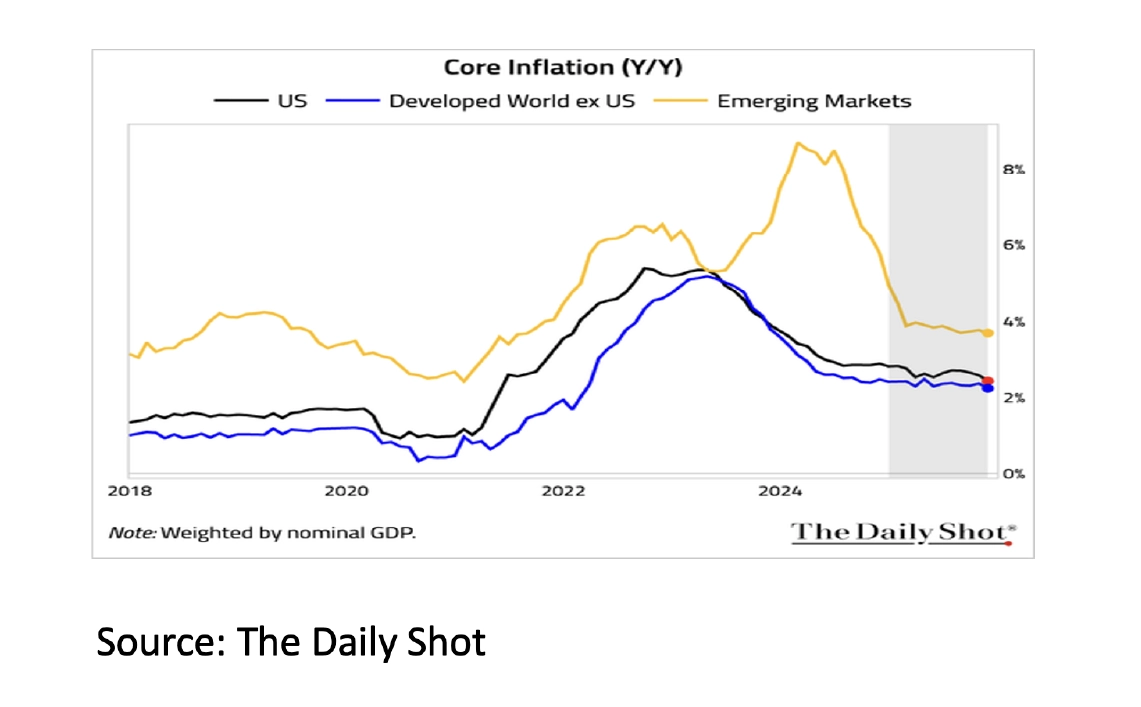

- Core inflation fell in many countries, though often only slightly.

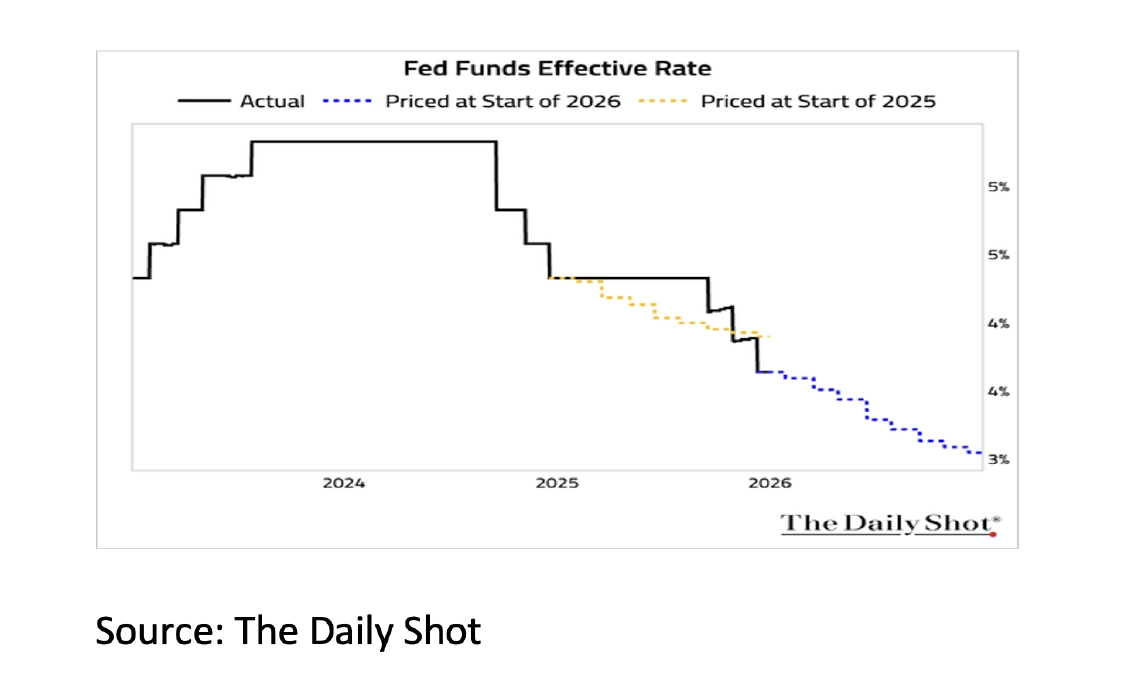

- Many central banks, such as the Fed (-75bp), the ECB (-100bp), and the BoE (-75bp), cut interest rates. The BoJ (+50bp) was an exception.

- The US intervention in Venezuela and the uprising in Iran show that geopolitical issues will continue to dominate the news in 2026. It is noteworthy that these consistently lead to lower, not higher, oil prices.

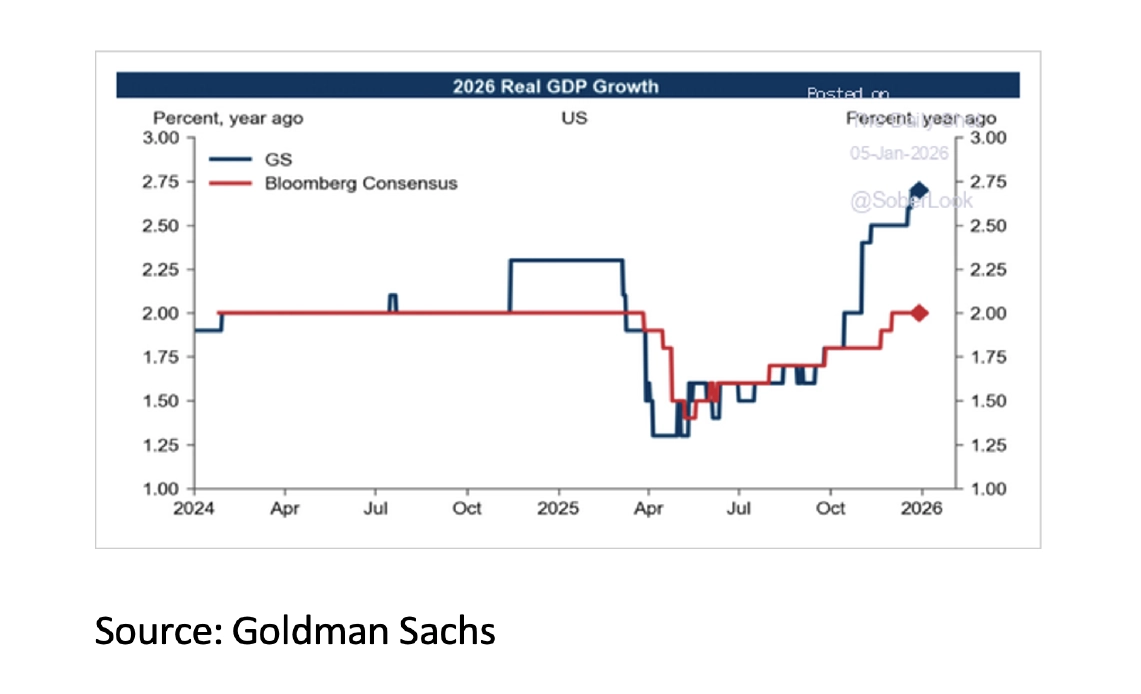

- According to the consensus, US economic growth will be +2% in 2026. Goldman Sachs is even slightly more optimistic at +2.75%.

- Goldman Sachs is also slightly more positive for the Eurozone and China (+1.3% and 4.8% respectively) than the consensus (+1.2% and 4.5% respectively).

- The Fed is expected to cut rates again in 2026 by around 75bp to 3.0%.

- According to the consensus, inflation will continue to decline slightly in 2026 and the chance of a recession in the US is less than 25%.

- Silver was the star performer in 2025, rising 138.6% (in USD). The S&P 500 rose +16.4% for the third year in a row.

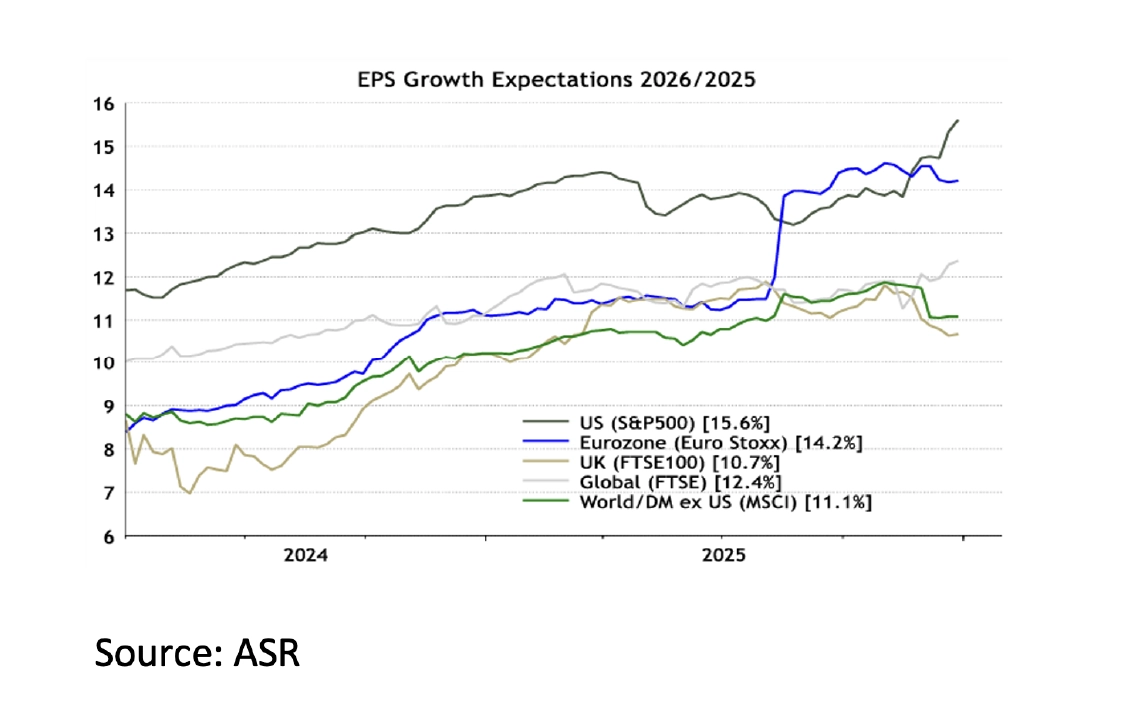

- Expectations for equities are also positive for 2026. The outlook for corporate profitability continues to be strong in both the US (+15.6%) and the Eurozone (+14.2%).

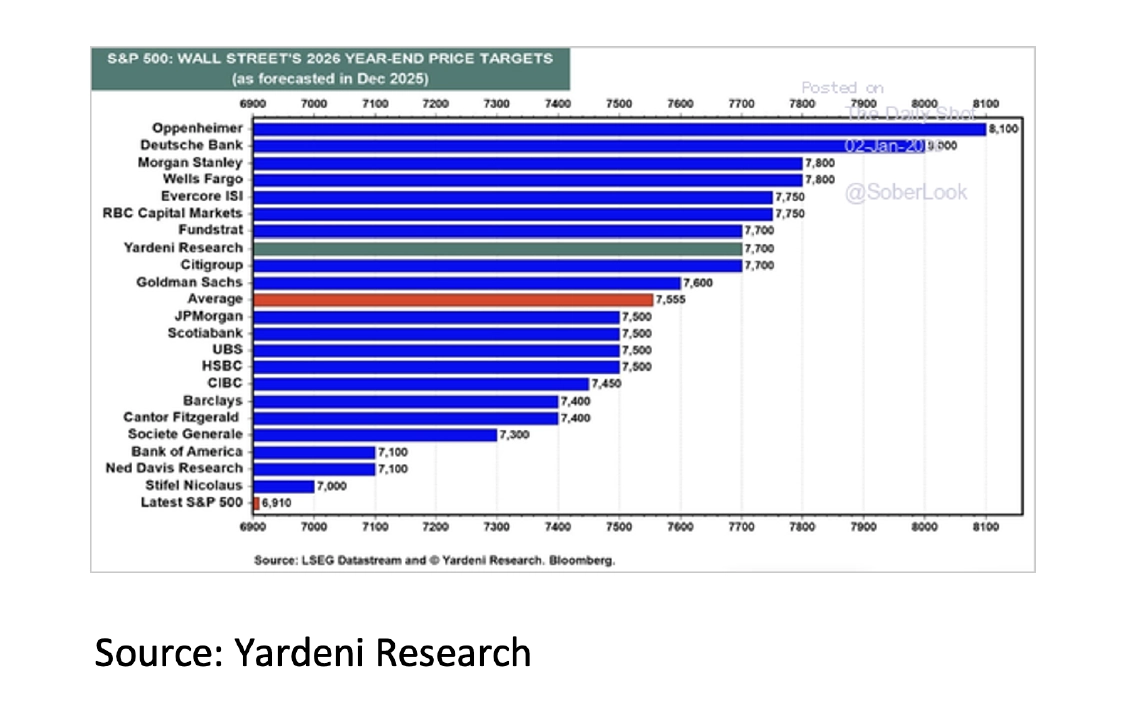

- Banks and brokers predict a rise of more than 10% for the S&P 500.

Despite the ongoing war in Ukraine, the tragedy in Gaza, and the trade war launched by President Trump with his "war on tariffs," economic growth in 2025 was higher than expected in many countries, and in some cases even slightly higher than in 2024. Core inflation also declined, albeit often only slightly. Notable in the US was the negative economic growth in 2025Q1, a direct consequence of the "war on tariffs" announced by President Trump at the time. Partly due to rising unemployment rates, these outcomes prompted many central banks, such as the Fed (-75bp), the ECB (-100bp), and the BoE (-75bp), to lower interest rates. The BoJ (+50bp) was one of the few exceptions.

Although the aforementioned geopolitical conflicts will continue to play a role in 2026, compounded by the recent US intervention in Venezuela and the uprising in Iran, the economic outlook remains positive. Notably, many of these geopolitical issues, unlike in the past, consistently lead to lower oil prices. According to the consensus, US economic growth will be +2% in 2026. Goldman Sachs is even slightly more optimistic, at +2.75%. The consensus expects the Fed to lower interest rates again in 2026 by around 75bp, from the current 3.75% to 3.0%. Goldman Sachs (+1.3% and 4.8%, respectively) is also slightly more positive than the consensus (+1.2% and 4.5%, respectively) for the Eurozone and China. According to the consensus, inflation will continue to decline slightly in 2026 and the chance of a recession in the US in 2026 is considered to be less than 25%.

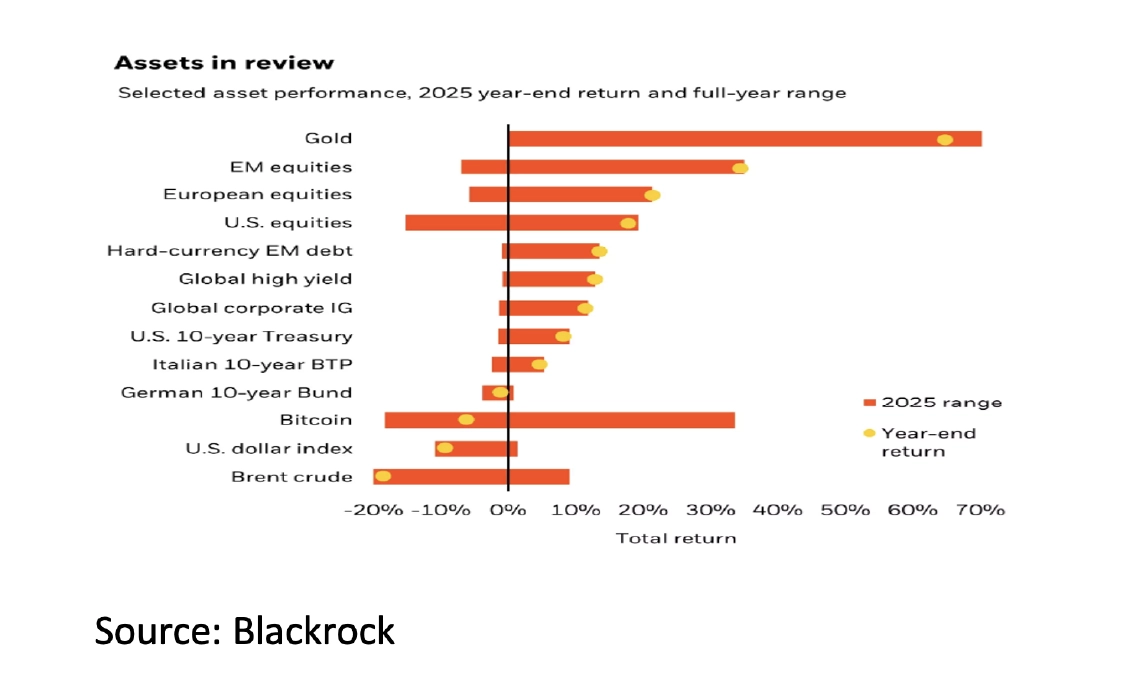

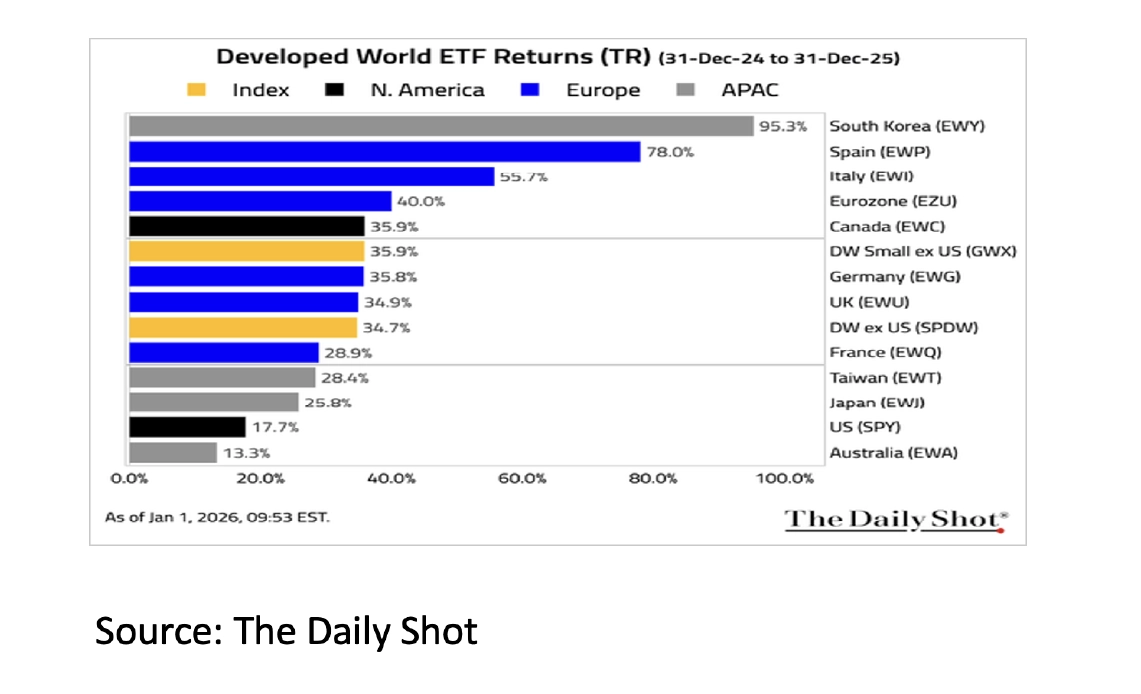

With a rise (in USD) of 138.6%, Silver was the star performer in 2025, followed at a considerable distance by the ETFs of South Korea (+95.3%) and Spain (+78%), and by Gold (+62.5%). Bitcoin and Brent Crude Oil were losers, with declines of more than 5% and 20%, respectively. In local currency terms, the rise of the S&P 500 (+16.4%) lagged the Euro Stoxx 50 (+18.3%) for the first time in years. A Euro investor also lost around 12% on the US dollar.

Stocks rose for the third year in a row, and perhaps it's therefore understandable to be a bit anxious. However, there's currently no reason why the current high valuations should pose a problem in the short term. Expectations for stocks are also positive for 2026. The outlook for economic growth is favourable globally, and corporate profitability continues to be strong in both the US (+15.6%) and the Eurozone (+14.2%). Moreover, history shows that four or even five consecutive positive years are possible. Furthermore, the midterm years of second-term presidents, such as President Trump, with an average gain of +8.8%, are generally not bad years for stocks. Banks' and brokers' forecasts for the S&P 500 for the end of 2026 are all positive, ranging from 7,000 to 8,100, with an average of 7,550, an increase of slightly over 10%. The outlook for government bonds remains moderate. The real interest rate on government bonds remains too low and it seems too early for a safe haven asset.

Disclaimer:

While the information contained in the document has been formulated with all due care, it is provided by for information purposes only and does not constitute a professional advice. We would encourage you to seek appropriate professional advice before considering a transaction as described in this document. No liability is accepted whatsoever for any direct or consequential loss arising from the use of this document.